Month: October 2025

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook

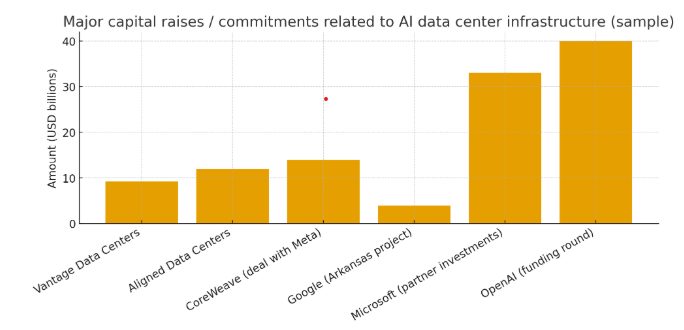

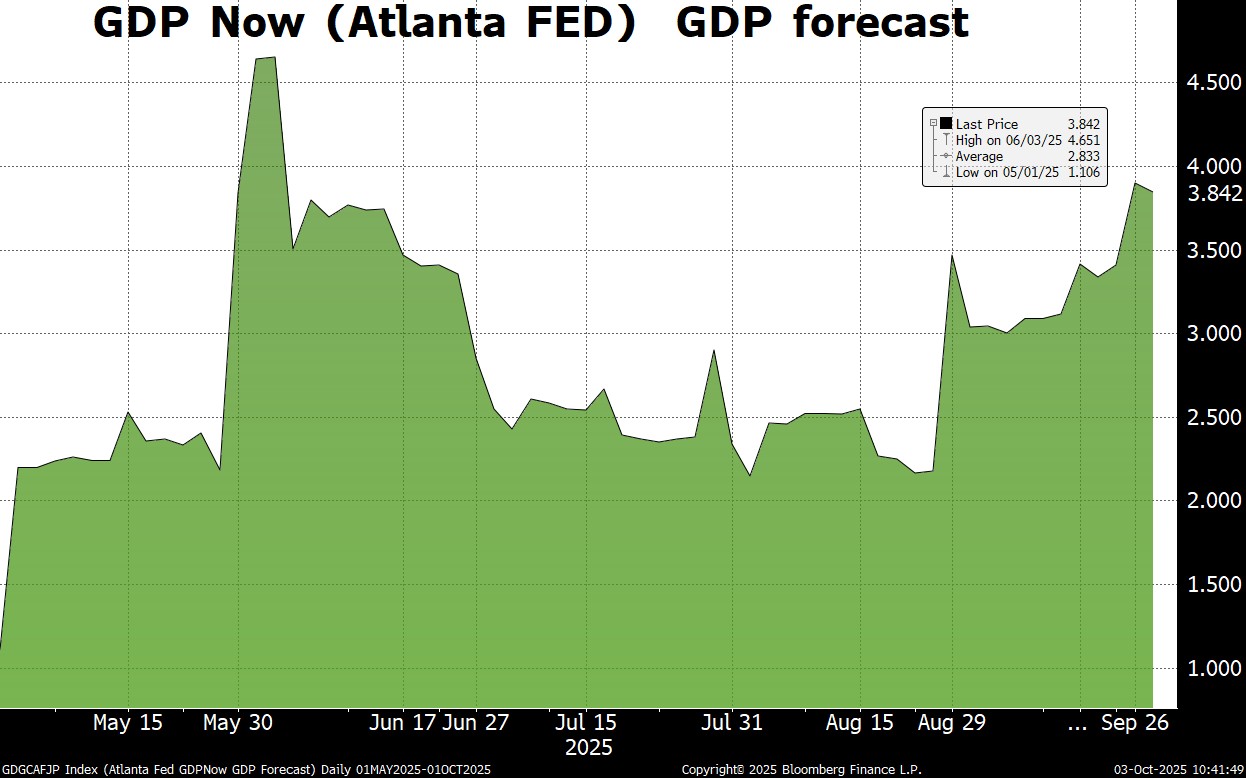

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook Overview The US economy is thriving as wealthy visionary investors’ pour billions of dollars into the foundations of a smart world. Over the last decade technologies for making the world smart have emerged and visionaries like Sam Altman, Elon Musk, Jensen Huang, Mark Zuckerberg, and Alex Karp, have led the way in funding and motivating the world to join hands with them and embrace super intelligence. Something that could change the world dramatically. Over the last few years, we’ve seen major investments from the hyper-scalers, hedge funds, and private equity funds, in the first phase of super intelligence, which is inference-based logic. (Figure 1) The construction of Compute and Data centers has started to accelerate and there is a wave of companies benefiting from this secular super cycle that will last for decades. Outsized demand for chip logic, networking, command center software, and power is all part of this super cycle. America is at the center of this exciting consumption theme. China and other parts of the globe who have been asleep have started to wake up and are slowly getting into the game. China is seeking to monopolize technologies for batteries and the mining of lithium-based commodities. America clearly holds the lead on hardware and software compute. Outside of the AI buildout, we see slow to moderate growth from consumption themes that center on entertainment and leisure, healthcare and obesity, digital devices, social media and digitization of data. There is also a modest theme of weapons & defense building for new types of weapons for wars that are fought with drones instead of tanks and manned fighter jets. Inflationary expectations have not moved to the ultra-low level of the past but are manageable and as a result the FED just recently cut rates for the first time. This environment is Nirvana for stocks! Economic Review Q3 2025 Inflation has subsided but we are still experiencing pricing problems in food, meals out, entertainment, movie prices, and visits to theme parks. Tariffs have showed up in food prices and auto prices but for the most part foreign manufacturers and US retailers have consumed most of the tariffs. Solid employment continues to be the backbone of this economic cycle. Unemployment remains at 4.3% or lower. Job openings have declined from the 10,000 per month pace of 2023 but still remain relatively high at 7,000 or more. (Figure 3) Most employers have their team back at the workplace for industries that require and need everyone together. Government debt continues to be the rot in the economy but for the most part it is in the hands of a borrower who is able to print money to service the debt. Consumer mortgage debt is also not a problem and remains at manageable prudent levels, and even consumer installment debt while high has less than a 3% delinquency problem currently. The only debt problem noticeable is in auto loans to subprime borrowers that have had defaults of 10% or more. This is a minor part of the debt in the American economy and will not domino into other areas. Economic Growth Growth in America continues to surprise everyone. The Atlanta FED or GDP now is forecasting 3.9% growth for the remainder of 2025. (Figure 2) While many economists and pundits believe the economy is in trouble there is just not that much sign of it on the horizon. Earnings expectations for the S&P 500 are at their best level in over three years with 12% growth expected in 2025 and similar growth in 2026. While the cyclical side of our economy is showing only modest growth and many parts of it are in recession, the tech and service side of our economy is producing strong growth with the magnificent seven growing earnings at 20% or more. The US Consumer the US consumer remains resilient supported by wage growth of over 3% for the last decade matching or exceeding inflation. While consumer confidence is low retail sales and personal consumption numbers continue to rise at a linear pace. The biggest problem that we have in the US economy is the weak housing sector. Existing home sales are at anemic levels and new home sales are only half of good levels. Consumers are locked into existing homes with ultra-low mortgages and refuse to sell and give up these attractive 2-4% mortgages. As a result, there is not much turnover in housing and any industry tied to home sales is struggling. The weak housing sector has resulted in a manufacturing sector that is in recession with industrial production numbers at levels not seen in over a decade. This is a problem not only for America but for China who manufacturers most of the goods that are consumed around the globe. Financial Market Review The equity markets in America and around the globe did extremely well in the third quarter. The best returns were in secular growth companies tied to what’s going on with technology and the pursuit of a smart world. Expectations rose for artificial intelligence, compute providers, and most of the companies involved in the buildout. Similarly, there was a rise in expectations for the producers of power as well as battery technologies. Apple Computer introduced their iPhone 17 with smart intelligence included that have boosted sales and expectations. Apple has been slow to incorporate artificial intelligence into their phones but is now playing catch-up and the market is excited to see them get into the game. Tesla saw expectations rise significantly during the quarter as Elon Musk positioned himself with one of the best pay packages ever for a corporate CEO with huge rewards for shareholders if he’s able to achieve the goals he set for himself. Tesla’s exposure to robotics and battery technologies add to their already dominant position in electric vehicles. Investors in the healthcare provider industry finally found some relief as expectations rose from extremely low levels as pessimism finally gave way to optimism for better returns in managed-care. Generally large-cap growth stocks far outperformed large-cap value stocks in the most recent quarter. The Russell 1000 large-cap growth ETF rose 10.4% compared to the Russell 1000 value which gained a mere 5.3%. The magnificent seven advanced 21% versus 8.9% for the S&P 500. MACM’s dynamic growth portfolio beat the S&P 500 in the quarter advancing 9.6%. Small-cap stocks which haven’t participated significantly in the equity rally for several years played catch-up and returned over 12% in the quarter. Most of Europe and emerging Asia lagged the American markets with returns in the 3 to 5% range. Likely because there are few companies in these areas of the globe that are leveraged to artificial intelligence or the theme of making the world smart. Real estate has struggled to move higher from extremely extended levels and both REITs as well as prices of individual properties were stagnant in the recent quarter. Bitcoin advanced 6% while fixed income logged very modest returns of 1 to 2%. Economic Outlook The outlook for the US economy is quite good driven by the fundamentals for artificial intelligence and the themes of making America smart. Consumers are gainfully employed and wages have kept up with inflation. Most economists expect GDP growth of 2 ½% in the year ahead and over 12% earnings growth for the S&P 500. The themes of consumption that will continue in the year ahead involve artificial intelligence, entertainment and leisure, digitization of data, e-commerce, social media, electric vehicle production, robotics, battery production, power plant construction, and solar. We are avoiding or minimizing exposure to areas of the economy that are deeply cyclical like energy, commodities, manufacturing of durable goods, or garments and apparel. Financial Market Outlook Equities are better positioned than any other risk asset. The 9% returns achieved in the last few quarters will likely continue throughout the rest of the year. Value stocks will continue to underperform growth stocks and cyclical areas will continue to underperform secular growth areas. We think expectations will rise for energy enablers, battery producers, healthcare providers and hyper-scalers. We think most of the secular growth companies involved in the consumption themes noted above will see strong earnings growth and while their valuations may not expand their growth will drive higher stock prices of 5 to 10% or more. Fixed income returns will likely be modest as inflation and central-bank accommodation will continue to disappoint investors. The mania involved in bitcoin is likely to continue and the companies that surround this industry will benefit. We remain optimistic. Figure 1 Capital Raise for AI Buildouts Figure 2 GDP Forecast

Figure 2 GDP Forecast

Figure 3 Job Opening in America

Figure 3 Job Opening in America