Economic Outlook

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook

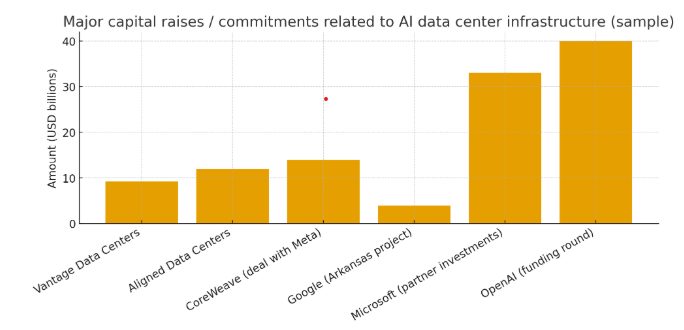

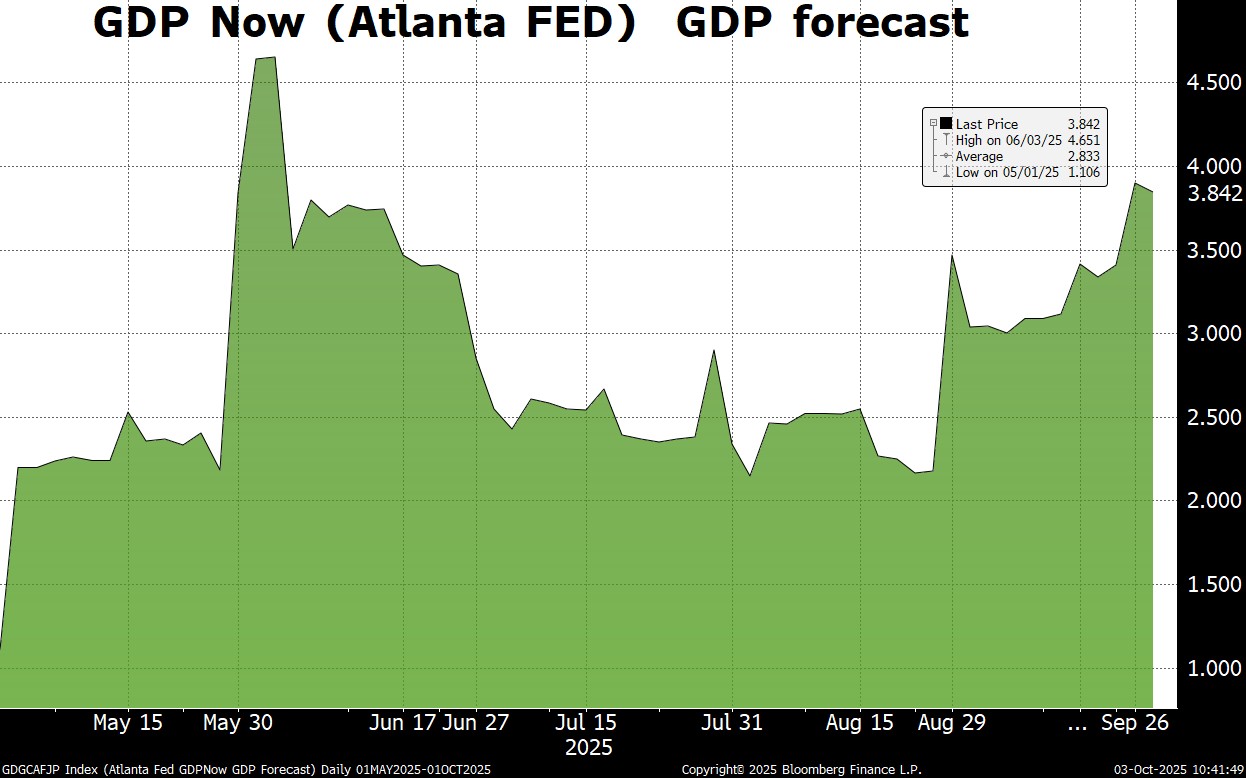

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook Overview The US economy is thriving as wealthy visionary investors’ pour billions of dollars into the foundations of a smart world. Over the last decade technologies for making the world smart have emerged and visionaries like Sam Altman, Elon Musk, Jensen Huang, Mark Zuckerberg, and Alex Karp, have led the way in funding and motivating the world to join hands with them and embrace super intelligence. Something that could change the world dramatically. Over the last few years, we’ve seen major investments from the hyper-scalers, hedge funds, and private equity funds, in the first phase of super intelligence, which is inference-based logic. (Figure 1) The construction of Compute and Data centers has started to accelerate and there is a wave of companies benefiting from this secular super cycle that will last for decades. Outsized demand for chip logic, networking, command center software, and power is all part of this super cycle. America is at the center of this exciting consumption theme. China and other parts of the globe who have been asleep have started to wake up and are slowly getting into the game. China is seeking to monopolize technologies for batteries and the mining of lithium-based commodities. America clearly holds the lead on hardware and software compute. Outside of the AI buildout, we see slow to moderate growth from consumption themes that center on entertainment and leisure, healthcare and obesity, digital devices, social media and digitization of data. There is also a modest theme of weapons & defense building for new types of weapons for wars that are fought with drones instead of tanks and manned fighter jets. Inflationary expectations have not moved to the ultra-low level of the past but are manageable and as a result the FED just recently cut rates for the first time. This environment is Nirvana for stocks! Economic Review Q3 2025 Inflation has subsided but we are still experiencing pricing problems in food, meals out, entertainment, movie prices, and visits to theme parks. Tariffs have showed up in food prices and auto prices but for the most part foreign manufacturers and US retailers have consumed most of the tariffs. Solid employment continues to be the backbone of this economic cycle. Unemployment remains at 4.3% or lower. Job openings have declined from the 10,000 per month pace of 2023 but still remain relatively high at 7,000 or more. (Figure 3) Most employers have their team back at the workplace for industries that require and need everyone together. Government debt continues to be the rot in the economy but for the most part it is in the hands of a borrower who is able to print money to service the debt. Consumer mortgage debt is also not a problem and remains at manageable prudent levels, and even consumer installment debt while high has less than a 3% delinquency problem currently. The only debt problem noticeable is in auto loans to subprime borrowers that have had defaults of 10% or more. This is a minor part of the debt in the American economy and will not domino into other areas. Economic Growth Growth in America continues to surprise everyone. The Atlanta FED or GDP now is forecasting 3.9% growth for the remainder of 2025. (Figure 2) While many economists and pundits believe the economy is in trouble there is just not that much sign of it on the horizon. Earnings expectations for the S&P 500 are at their best level in over three years with 12% growth expected in 2025 and similar growth in 2026. While the cyclical side of our economy is showing only modest growth and many parts of it are in recession, the tech and service side of our economy is producing strong growth with the magnificent seven growing earnings at 20% or more. The US Consumer the US consumer remains resilient supported by wage growth of over 3% for the last decade matching or exceeding inflation. While consumer confidence is low retail sales and personal consumption numbers continue to rise at a linear pace. The biggest problem that we have in the US economy is the weak housing sector. Existing home sales are at anemic levels and new home sales are only half of good levels. Consumers are locked into existing homes with ultra-low mortgages and refuse to sell and give up these attractive 2-4% mortgages. As a result, there is not much turnover in housing and any industry tied to home sales is struggling. The weak housing sector has resulted in a manufacturing sector that is in recession with industrial production numbers at levels not seen in over a decade. This is a problem not only for America but for China who manufacturers most of the goods that are consumed around the globe. Financial Market Review The equity markets in America and around the globe did extremely well in the third quarter. The best returns were in secular growth companies tied to what’s going on with technology and the pursuit of a smart world. Expectations rose for artificial intelligence, compute providers, and most of the companies involved in the buildout. Similarly, there was a rise in expectations for the producers of power as well as battery technologies. Apple Computer introduced their iPhone 17 with smart intelligence included that have boosted sales and expectations. Apple has been slow to incorporate artificial intelligence into their phones but is now playing catch-up and the market is excited to see them get into the game. Tesla saw expectations rise significantly during the quarter as Elon Musk positioned himself with one of the best pay packages ever for a corporate CEO with huge rewards for shareholders if he’s able to achieve the goals he set for himself. Tesla’s exposure to robotics and battery technologies add to their already dominant position in electric vehicles. Investors in the healthcare provider industry finally found some relief as expectations rose from extremely low levels as pessimism finally gave way to optimism for better returns in managed-care. Generally large-cap growth stocks far outperformed large-cap value stocks in the most recent quarter. The Russell 1000 large-cap growth ETF rose 10.4% compared to the Russell 1000 value which gained a mere 5.3%. The magnificent seven advanced 21% versus 8.9% for the S&P 500. MACM’s dynamic growth portfolio beat the S&P 500 in the quarter advancing 9.6%. Small-cap stocks which haven’t participated significantly in the equity rally for several years played catch-up and returned over 12% in the quarter. Most of Europe and emerging Asia lagged the American markets with returns in the 3 to 5% range. Likely because there are few companies in these areas of the globe that are leveraged to artificial intelligence or the theme of making the world smart. Real estate has struggled to move higher from extremely extended levels and both REITs as well as prices of individual properties were stagnant in the recent quarter. Bitcoin advanced 6% while fixed income logged very modest returns of 1 to 2%. Economic Outlook The outlook for the US economy is quite good driven by the fundamentals for artificial intelligence and the themes of making America smart. Consumers are gainfully employed and wages have kept up with inflation. Most economists expect GDP growth of 2 ½% in the year ahead and over 12% earnings growth for the S&P 500. The themes of consumption that will continue in the year ahead involve artificial intelligence, entertainment and leisure, digitization of data, e-commerce, social media, electric vehicle production, robotics, battery production, power plant construction, and solar. We are avoiding or minimizing exposure to areas of the economy that are deeply cyclical like energy, commodities, manufacturing of durable goods, or garments and apparel. Financial Market Outlook Equities are better positioned than any other risk asset. The 9% returns achieved in the last few quarters will likely continue throughout the rest of the year. Value stocks will continue to underperform growth stocks and cyclical areas will continue to underperform secular growth areas. We think expectations will rise for energy enablers, battery producers, healthcare providers and hyper-scalers. We think most of the secular growth companies involved in the consumption themes noted above will see strong earnings growth and while their valuations may not expand their growth will drive higher stock prices of 5 to 10% or more. Fixed income returns will likely be modest as inflation and central-bank accommodation will continue to disappoint investors. The mania involved in bitcoin is likely to continue and the companies that surround this industry will benefit. We remain optimistic. Figure 1 Capital Raise for AI Buildouts Figure 2 GDP Forecast

Figure 2 GDP Forecast

Figure 3 Job Opening in America

Figure 3 Job Opening in America

Trump takes on the Global Trade Crisis with Tariffs that are Spooking Investors

Trump takes on the Global Trade Crisis with Tariffs that are Spooking Investors By Mitchell Anthony April 4, 2025 America continues to thrive despite an industrial sector that has been forced into decline by unfair Global trade policies. America’s success is under siege and we must take action to change! While globalization is great in a world with common goals. That has not materialized and the goals of America are not really aligned and shared by the rest of the Globe. America is and has been all about innovation and capitalism, while the rest of the world embraces socialism and communism at the expense of American wealth. This is now forcing America to reverse course from the globalistic path that we pursued in the 90’s. China is a huge threat to our freedom and our capitalistic success and we can no longer give away our wealth to socialistic countries and allow unfair Trade competition. Past leaders have been too weak to take on this fight. While Trump is a lot of puffed air and does not have good poise or dignity, it seems that he is the right medicine for what America needs today!! Read moreFinancial Markets Volatile as Rates Move up to 12 Month High

Financial Markets Volatile as Rates Move up to 12 Month High US Economy Performing Better than Expected with Select Group of Stocks moving Higher January 5, 2025 By Mitchell Anthony The US economy continues to surprise almost everyone! An economic slowdown or recession has been expected for the last two years but has not materialized. Employment has remained strong and retail sales and consumer confidence which had fallen off in early 2024 have begun to recover. The Fed had planned to lower rates much further but has seemingly made his last cut until further signs of economic weakness emerge. He is now not convinced that inflation is bottled up. (CPI Figure 3) The financial markets have been confused by the economy and the Fed which have both given us mixed signals on what lies ahead. Will inflation start to tilt back up again and put a clear end to the hope for lower rates? The Industrial side of the economy has been in recession for over a year and most industrial stocks have performed poorly as a result. The best performance in the equity market has come from large cap growth stocks which seem immune to the economic cycle and are driven more by secular consumption themes. This was clearly illustrated in the performance of stocks in the fourth quarter. The magnificent seven stocks were up over 15% while most value cyclical indices were down and had negative returns. (Figure 1) MACM’s dynamic growth portfolio was up over 5% for the quarter compared to only 2% for the S&P 500 and -2% for most large-cap value indices. The alpha created in Q4 by MACM was largely a result of heavy weightings in secular growth companies and mag seven stocks.Read moreDistressed Financial Assets Shine after Years of Poor Performance

Distressed Financial Assets Shine after Years of Poor Performance October 5, 2024 By Mitchell Anthony US Economy slows and market leadership takes a pause? Financial markets across the board performed well in the third quarter of 2024. Equities gained again after three straight quarters of solid returns. Fixed income which had not performed well for many quarters saw strong gains as interest rates fell significantly, and alternative investments like bitcoin had another good quarter as well. Opinions about the economy changed significantly from week to week throughout the quarter. Many strategists were expecting soft growth or recession to emerge however this was not the case and GDP came in much stronger than expected at 3% which is well above the trend it had been on for several years. These strategists were worried about a hard landing in the economy and that the Fed’s actions to tame inflation would ultimately bust this economic cycle. Seems as though they were wrong! The Inflation cycle for the most part ended and with it came lower interest rates across the board from short-term rates to longer-term mortgage rates. The decline in rates was as much as 50 basis points or one half of 1%. Investors hoping for rates to return to the near zero levels of the last decade rushed into bonds and ran prices up and yields down. This seemed to most seasoned investors to be a bit premature? Read moreMag 7 Stocks Boom in 2nd Quarter Despite Higher Rates

Mag 7 Stocks Boom in 2nd Quarter Despite Higher Rates Magnificent Seven stocks gain 17% in 2nd Quarter! The US economy finally seems to be on a path of slower growth; however, interest rates still remain quite high, causing investors to ponder why. At the same time, earnings growth for corporate America is waning as higher inflation has pushed wages up and corporate margins down. The areas of the US economy that are growing are narrow and centered on very strong secular consumption themes of artificial intelligence, web computing, cybersecurity, digital devices, and obesity. The broader part of the US economy is not benefiting from these consumption themes, and it is mostly benefiting the magnificent seven and a few other mega-cap names. The long-awaited decline in interest rates that investors have been anticipating has been hampered by growing US debt. US government debt is now over $36 trillion and has grown from $12 trillion since 2010, and from $25 trillion to $36 trillion just over the last four years. As a result of this alarming acceleration in debt, investors are demanding higher returns on US treasury debt. The spread that US treasury debt pays over inflation is in excess of 200 basis points, which is close to a historic high. (Figure 1) Normally, US treasuries yield approximately 1% more than the inflation rate. That would put treasury rates at 3.6%, but they are currently yielding 4.6%. Economic Review Q2 2024 Work from Home There are several economic themes at play in the US economy. Working from home has been adopted and pushed by employees of corporate America and began during COVID. US employees have become comfortable with the unaccountability of working from home and many have refused to come back to the workplace. Tight employment has allowed these themes to continue. Employers want control back and have been monitoring the work that is being done at home by their employees. Employees have been found cheating and using keyboard software to imitate work while they leave their homes and do personal errands. Wells Fargo fired dozens of those employees last month who were caught with this software on their workstations at home. Employers are partially winning the battle, and it seems like we have a hybrid model that is being embraced where employees are required to be in the office at least 2 to 3 days per week. Regardless, this has been a headwind for productivity, but fortunately, it has been offset by artificial intelligence that is allowing employers to do work without as many employees. US Debt at Troubling Levels As noted above, US debt is rising as budget deficits get worse, compounded by a decline in perceived credit quality for US treasuries. (figure 2) US debt service relative to GDP is at an all-time high, further stretching deficits. It is uncertain what the endgame will be and could be drastically different given a Trump victory versus a Biden victory. Economic Growth The growth rate of the US economy is slowing, and GDP last quarter was only 1.4%. (figure 3) At the same time, corporate profits have gone flat for most of corporate America. Margins are eroding with higher costs of wages. The number of companies with strong earnings growth is a short list and seems to be related to the consumption themes noted above. US Consumer The status of the US consumer is difficult to pin down. On one hand, the US consumer is enjoying wages that are growing above the inflation rate, while on the other hand, consumers seem to be at the end of reasonable capacity to consume. The amount of debt they have accumulated does not seem excessive yet with what is measurable, although there is phantom debt in the US economy related to buy-now and pay-later type terms being offered by many retailers across corporate America. It is estimated that phantom debt is currently over $300 billion. Consumer sentiment has fallen, as has consumer confidence. Personal income and personal consumption are showing modest growth, but only because of population growth, and actual per capita consumption is in decline. Nominal retail sales are flat, and inflation-adjusted retail sales are in significant decline. Existing home sales have been flat and are now turning lower, and new home sales are starting to break to the downside a bit as well. Mortgage delinquencies are trending higher but still at very low levels. The industrial and manufacturing side of our economy remains in a modest decline that began more than a year ago. Durable goods have declined, and only consumer services have tilted upward. Inflation Data The inflation picture is improving steadily as both CPI and PPI have trended lower and are getting closer to the Fed's targets. This is occurring alongside steady but slower growth. Housing and insurance are still rising and are the strongest part of the inflation report. While inflation is trending lower, US debt is rising exponentially, keeping yields up despite lower levels of inflation. Financial Market Review The financial markets have enjoyed three consecutive quarters of outstanding performance. The last quarter was again great for equities, but market leadership has narrowed with the magnificent seven far outperforming the S&P 500. The MAG 7 was up 17% vs. 4.3% for the S&P 500. MACM’s Dynamic Growth (DG) advanced 7.5%, 320 basis points more than the S&P 500. It was a difficult quarter for fixed income, whether you owned treasuries, corporate bonds, mortgage bonds, or municipal bonds. For the most part, they all lost money as interest rates tilted a bit higher during the quarter. Intermediate treasuries lost over 2%, while short-term treasuries and municipal bonds were mostly flat. As inflationary expectations subsided during the quarter, concerns built about the creditworthiness of the US government, and as a result, treasuries lost ground. The reckless spending by Congress and the current White House expanded government debt by over $10 trillion over the last four years. (figure1) Just not a great time to own fixed-income securities. Bitcoin and Alternatives Bitcoin lost ground, as did other alternative investments like real estate and commodities. Real estate investment trusts mostly fell, with the XLRE dropping 1.9% and the IYR declining a bit over 1%. Housing REITs did a bit better. Bitcoin declined by over 13%. In the equity arena, large-cap growth stocks continued to far outperform value stocks, as represented by IWF vs IWD. (figure 4) From a sector perspective, tech and communication services were the front runners, gaining 8.8% and 5.2% in the quarter, while materials, energy, and industrials lagged with losses of 2-4%. The secular growth theme that favors the magnificent seven is the wind at the back for growth. At the same time, the slow-growing global economy is a headwind for value-oriented industrials and financials. Foreign markets performed poorly, with both Europe and China producing returns half the amount of the US markets. These export-based economies are struggling in a world of slower growth and with no participation in innovation or technology-driven productivity enablers. Money has likewise stayed away from small-cap stocks that need stronger overall growth to thrive. Economic Outlook The global economy is growth-challenged despite employment being very strong, but this is being offset by higher costs of borrowing money and a consumer who remembers those 1% rates and thinks they’re coming back. Employers are unhappy that their employees want to work from home, and it is unclear how this will play out. It seems like employees will have their way until the economy busts. Employment is likely to weaken just a bit, but not enough to bring down rates. Possibly by the end of the year, but not likely. There is some slight weakness brewing from the consumer, and it will likely get a bit worse. It seems unlikely that the economy will grow through this inflation problem quickly. Either a bust or a long two-year period of soft growth would end the cycle for inflation, but it doesn’t seem like a bust is on the horizon. While new home sales have held up well, it seems like the recent trend of weakness is going to continue, and strength is not on the horizon. Higher prices and higher borrowing costs have hit spending on goods, and consumer services are now likely to follow with weakness for the same reasons. Manufacturing outside of technology will remain soft until the consumer is better. Corporate spending on web computing is the lone bright spot. Travel, web computing, high-density computers, leisure services, and digital devices are the best part of the economy, but eventually, even they can soften if the consumer does not get back on their feet again. Financial Market Outlook The return on non-risk assets (4%) is still quite low relative to people’s recent memory, and hence most investors are unwilling to leave risk assets for 4% returns. As a result, money continues to flow toward risk assets. Also, fixed-income investments like treasuries that were perceived as risk-free are now being perceived as having some credit risk. Treasury rates would seem to be range-bound between 4 to 4.5%. It would seem that money will continue to remain in risk assets. Equities seem better positioned than any other asset. There is still potential earnings growth to drive prices higher, and it is clear the magnificent seven are growing at a strong pace. These stocks will continue to lead the equity market higher, dragging along any companies associated with those same themes that are driving the magnificent seven. Secular growth stocks are the place to be for the foreseeable future. MACM’s equity strategies are loaded with secular growth stocks that are driving excess return in our managed portfolios over the S&P 500. We remain optimistic! Figure 1 – Spread of Treasuries over Inflation over 10 years

Figure 1 – Spread of Treasuries over Inflation over 10 years

Figure 2 – Total Outstanding Government Debt over 20 years.

Figure 2 – Total Outstanding Government Debt over 20 years.

Figure 3 – US GDP over last 5 years

Figure 3 – US GDP over last 5 years

Figure 4 Large Cap growth ETF vs Large Cap value ETF( +8% vs -2%)

Figure 4 Large Cap growth ETF vs Large Cap value ETF( +8% vs -2%)