Are Stocks and Real Estate Poised for a Bust

January 25, 2022

By Mitchell Anthony

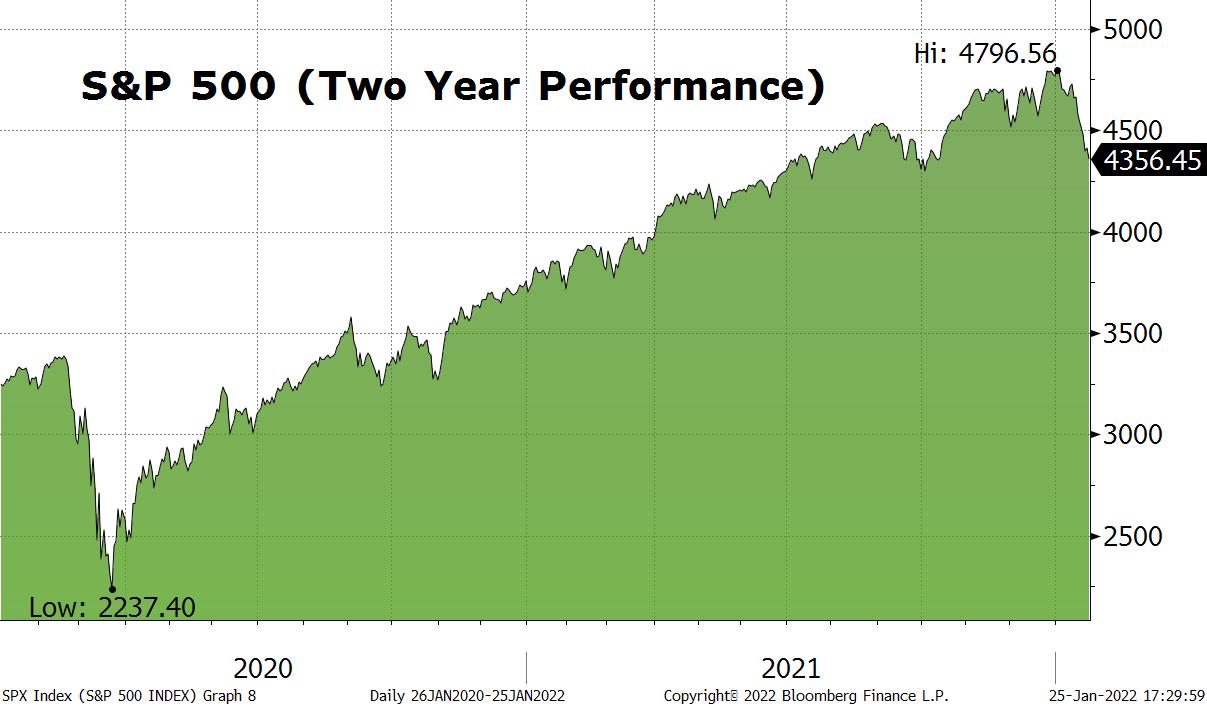

The equity market has been going through an extreme period of volatility over the last few months as investors fret about whether a soft landing or a recession is on the horizon. This volatility has everyone nervous because of substantial amounts of wealth that Americans have in our financial markets. If there is a meaningful recession then markets undoubtedly will correct 20% or more from past highs. Conversely if there is a soft landing for the problems that we are having with inflation and growth than the markets will get back on a path to higher prices as soon as this becomes visible. The market is clearly worried about inflation and much higher interest rates and as a result equity prices have already fallen 10 to 15% on equities and demand for homes has softened. This equity correction seems overdone and it would seem that prices will stabilize very soon as we await more data on inflation. We have never had a lasting substantial correction of more than 10% in equity markets that wasn’t driven by a substantial economic event. We have not yet had an economic event and do not believe one is upon us now, however we do recognize we are close to the amount we are willing to lose from a previous high before making sales to protect our assets. We also recognize that the equity Market has had a substantial move over the last two years (over 50% appreciation see figure 1 &2) that must be considered when identifying a stop loss point for the equity market. We believe that it is not time to panic and sell equities aggressively and move to cash but will do so soon if selling persists.

For a soft landing to be achieved the current problem with inflation must be resolved without substantially higher interest rates or a substantial decline in asset prices. The Fed has his hands full as he tries to rein in the excess liquidity that was put in the market by Congress during the early days of Covid that is now chasing goods and services and causing high inflation. The problem is not only due to that but also production bottlenecks that developed during Covid. The Fed has to stop current inflation because it has become dangerous to growth and stability of asset prices.

Investors will not tolerate a recession and will continue to sell stocks if more visibility develops of a recession on the horizon. Markets are already discounting a recession and higher rates somewhat but it is not the probable event expected by investors. They are simply hedging the probability that this might happen.

Interest rates have already risen by approximately three quarters of 1% on mortgages. Mortgage rates as measured by bank rate.com have jumbo loans currently being priced at 3.7% up from 3% just a few months ago. This is undoubtedly already slowing demand for homes a bit but historically demand for housing and related goods does not have a substantial decline until rates are over 4%. It could be in this cycle that rates may have to go to 4.5% before demand slows because this economic cycle is not as fragile as the last cycle or two.

Investors are also fretting about the earnings growth that lies ahead for the S&P 500. They’re particularly worried about highly valued secular growth companies like Amazon, Netflix, Google, Nvidia, and Tesla. Investors have recently decided to huddle in more value-oriented energy and financial names that are benefiting from the inflation and that they think will perform better while we assess whether recession lies on the horizon. While these names may outperform secular growth names in the very near term they will undoubtedly under-perform once the fears of recession subside and the inflation problem has been resolved.

The Outlook for the Economy and Markets

There’s a chance that the inflation problem cannot be resolved without a recession or substantial bust in the valuation of real estate and stocks. While this is the outside chance it is possible and we remain vigilant looking for signs that this will become reality and drive equity markets down 20% or more.

Clearly the Outlook is a bit uncertain with higher probabilities for a soft landing than a recession. There is still a lot of liquidity in the economy from overly stimulative policy by congress that is keeping confidence high and has been difficult for the fed to mop up without causing a bust in asset prices.

There are several factors in place that should bring down inflation, and begin to re-anchor inflation expectations back at 2%. This will calm investors, support asset prices and get the equity rally back on course. The factors would include:

- Monetary Policy changing as Chairman Powell is acutely focused on what needs to be done to contain inflation.

- Higher cost of money lowering demand for Goods/services

- Fiscal Policy has been a problem and Congress was overly stimulative with fiscal policy during Covid. However we note the following:

- The PPI money was spent by the majority and saved by the minority. It’s mostly gone and not there to continue to over stimulate the economy.

- Un-Employment subsidy gone now for 5 months which is already affecting wealth and retail sales.

- Mortgage forbearance gone and eviction moratorium gone.

- Excess savings that consumers accumulated because of fiscal stimulus is now mostly gone.

- The Child tax credit that was putting money in people’s pockets is now also gone.

- Wealth Effect from High Asset prices

- Homes prices are extended and undoubtedly will decline 5 to 10% as 75 BP higher rates affect affordability. While this is a bit problematic for the economy is probably not near enough to push us into recession

- Stocks are down by 10% already and wealth has been destroyed a bit. This will affect consumption and mute inflation.

- Production Bottlenecks resolving

- Shipping – BDI now back to Jan 2021 levels

- Non Chip based Manufacturing is back on track

- Chip based Manufacturing still has mild to moderate problems that will take another six months to work through.

In summary the outlook for the economy and the financial markets has clouds on the horizon that will likely clear as the current problem with inflation has a much larger probability of being resolved without recession or a bust in asset prices than not. We will get our next reading on inflation in approximately two weeks and that will set the tone for the posture we take with our portfolios under management. If the CPI and PCE show modest improvement our optimism will grow, conversely if they show further acceleration we will raise our forecast for recession and rearrange our portfolio with positions in consumer staples, energy, and treasuries. We may begin to rearrange with those positions a bit now on any strength or rally we have over the next few weeks. It’s likely the equity market will rally when Powell speaks this week!

Figure 2

Figure 1