US Economy Accelerates – Growth is Notable and Difficult to Explain

January 7, 2026

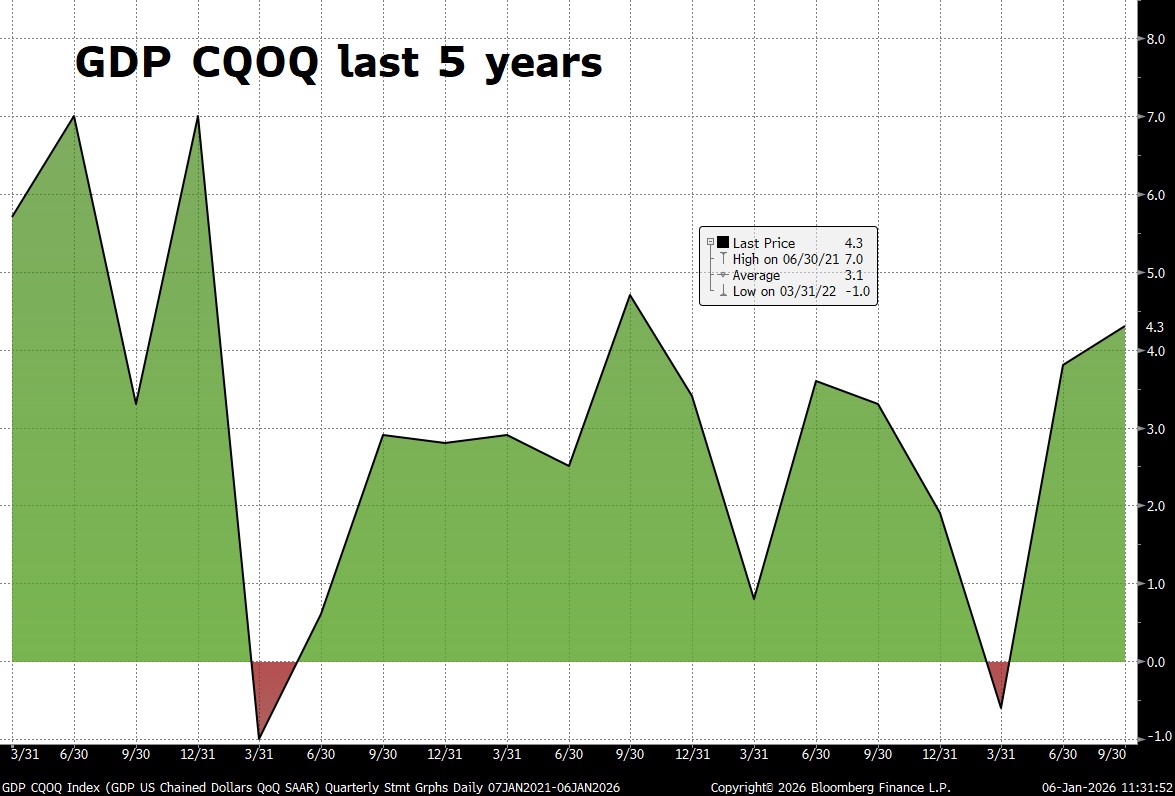

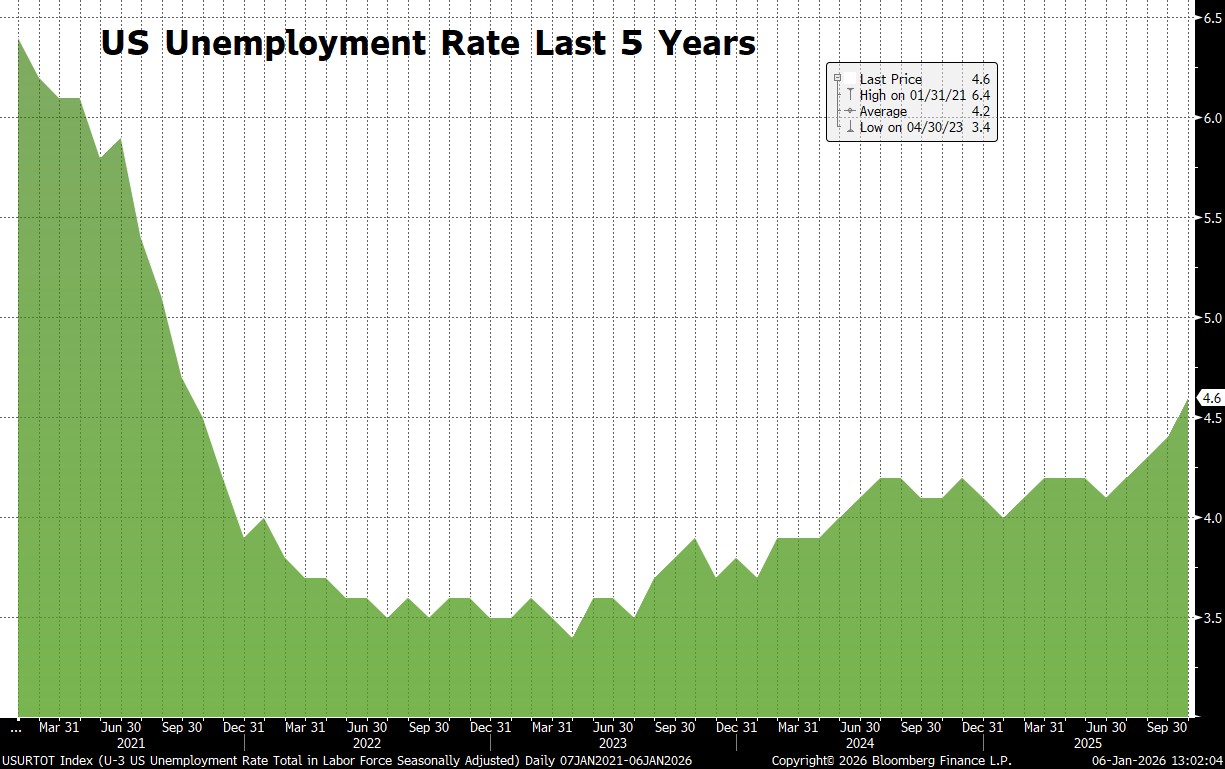

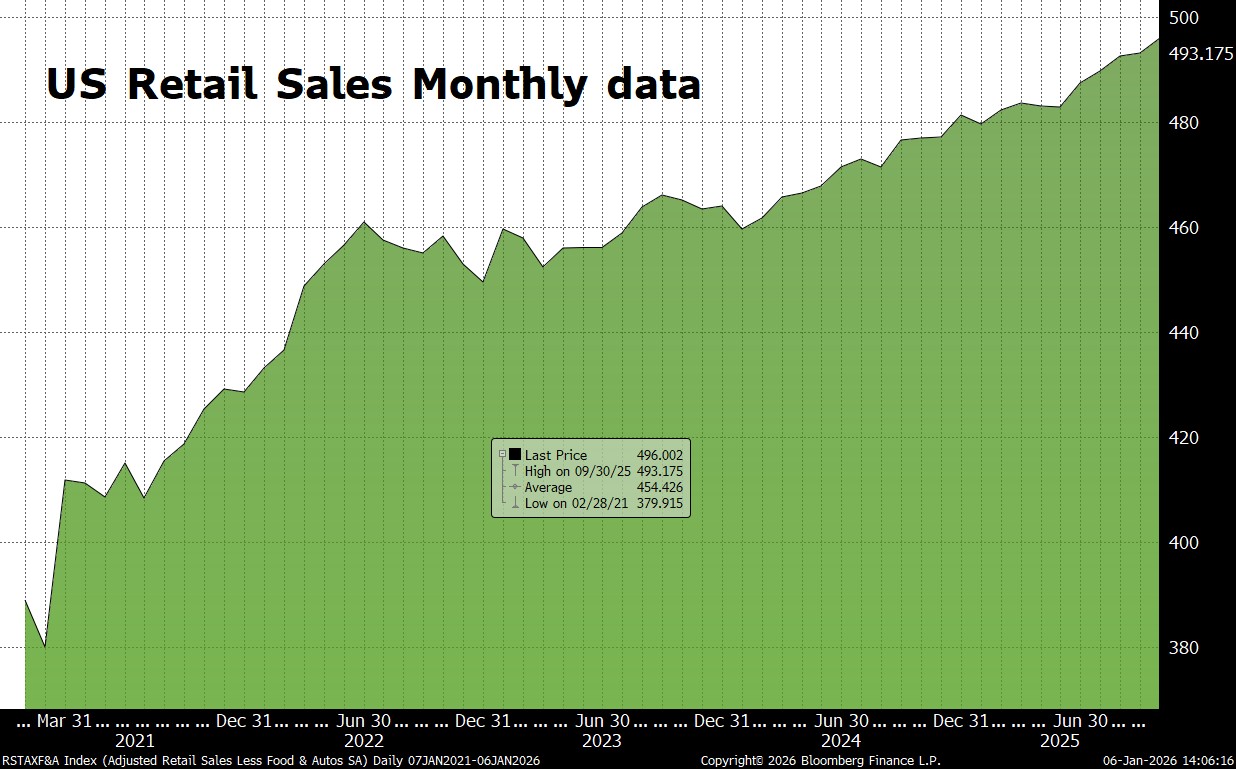

US Economy Accelerates – Growth is Notable and Difficult to Explain Overview 2025 was another great year for the economy and the financial markets. This comes after double-digit Equity returns in both 2023 and 2024 for the S&P 500 and MACM equity strategies. The fourth quarter of 2025 had modest equity returns but economic activity actually accelerated. GDP was over 4% (figure 1). For the year economic activity was robust despite gloomy forecasts from most economists who felt the economy could not stay on the path of strong growth for many reasons. However, earnings growth was strong for the year with the S&P registering over 13% growth in earnings and S&P 500 stock returns were close to 18%. MACM’s dynamic growth portfolio returned over 20%. The acceleration in the economy’s rate of growth as measured by GDP to 4.3% (figure 1) has been difficult to explain and understand. Clearly employment has been softening and confidence amongst consumers has reached new lows while at the same time the housing industry is stagnant. This is generally not aligned with strong economic growth. For whatever reason consumers have continued to spend and consume. (Figure 3). Entertainment and leisure spending led the way with international travel heading the list. Consumers are utilizing healthcare more than ever and healthcare as seen substantial growth because of this higher utilization rate. Consumers are embracing GLP’s and seeking to lose dramatic amounts of weight driving stronger consumption of these great products. Consumer spent strong on recreational goods in 2025. For the most part the best part of spending was in services and not in durable goods. Artificial intelligence cannot explain the strong growth we are experiencing. There is no doubt that we are going through a significant change in the world as the globe seeks to become smart and embraces substantial investments in artificial intelligence to enable super intelligence. This theme of spending on artificial intelligence has been exciting but a closer look at how much money is being spent and whether or not it is what’s driving the economy needed to be done to better explain the strength that we are seeing in the economy. There has been a big upturn in spending over the last few years on artificial intelligence. Lots of market pundits have explained the unusually strong economic growth by noting that over $400 billion was spent last year alone on the artificial intelligence buildout. How significant is this? Well certainly it is not a small amount of money, however, it is relatively small when you consider that the US economy alone produces over $20 trillion of goods and services each year. 400 billion is a very small part of how much is spent in our economy each year and is not nearly large enough be considered a major theme of consumption. The consumer is the main driver of the economy and spends over $15 trillion each year on goods and services. The corporate world spends less than $2 trillion each year and is a smaller player in the US economy. This analysis clearly leads us to conclude that the consumer is the backbone of this strong growth that we are seeing despite all the problems that have got in the way of the consumer like high levels of prices on services and high level of prices on homes and durable goods. Despite these high prices the consumer continues to spend and has been supported by wage growth that has kept up with inflation over the last five years. A Closer Look At The Economy Inflation. We have seen mild inflation in food and high inflation in meals out. Movie prices and park prices are up and entertainment in general cost much more. The rise in prices is over but the level of prices is still high. The inflation that we have seen over the last year did not live up to the expectations of the pessimists who were sure that tariffs would produce double-digit inflation. In the end CPI was under 3% for all of 2025 and the PCE was only 2 ½%. Employment. Unemployment has been rising and is now over 4.6% after bottoming at 3.4% in 2023 (figure 2). Job openings are down to 7700 from the over 10,000 level in 2023 but the decline has stopped and has been steady for 12 months. Employers claim to be hoarding labor and capacity as they anticipate the economy staying stronger than the pundits forecast. If they are wrong then unemployment could jump as they let go of the labor they are hoarding. Financial Market Review 2025 was a great year for financial markets. Equities advanced 15 to 20%, led again by the magnificent seven but small-cap stocks and the broader market also did well posting returns of 10 to 12%. European markets did well in the first quarter but then gave much of that back during the remaining part of the year but still posted double-digit returns. The big burst to the upside in the first quarter that was all about investors voting against America and Donald Trump and his pursuit of tariffs. Real estate had a disappointing year with single-family homes flat to 1 to 2% higher and most REITs posting modest returns of 3 to 5%. Precious metals had an amazing year with silver and gold making significant advancements of over 50%. Strangely though bitcoin lost over 6% in 2025! Gold silver and bitcoin have mostly been bought by investors who are fearful of the significant budget deficits that seem out of control and keep growing. Investors fear that they’ll be a bust of some sort and that the dollar and most currencies will lose their value and hence the only way to barter for things in the future will be through the exchange of gold or silver or bitcoin. While this type of thinking seems extreme it seems like the only explanation for the big run up in these precious metals. Fixed income markets had modest returns in 2025. The Fed did not lower interest rates significantly as many people predicted and that disappointed bond investors and the total return in most treasury funds was about 4% for the year. Corporate bond funds did a bit better returning 6 to 8%. Economic Outlook Growth Economic growth is forecast to be 2.9% in 2026 by the Atlanta Fed. The average market economist has a similar number. Earnings growth for the S&P 500 is projected to be 15% in 2020, a slight uptick from the 13% we saw in 2025. Earnings growth for 2026 by sector looks like this:- Tech 35%, Materials 22%, Industrials 12%, Comm Services 11%, Utilities 11%, Financials 8%, Financials, Energy 8%, Cons Disc 8%, Healthcare 7%, Staples 7% and Real estate 5%

Figure 2

Figure 2

Figure 3

Figure 3

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook

October 3, 2025

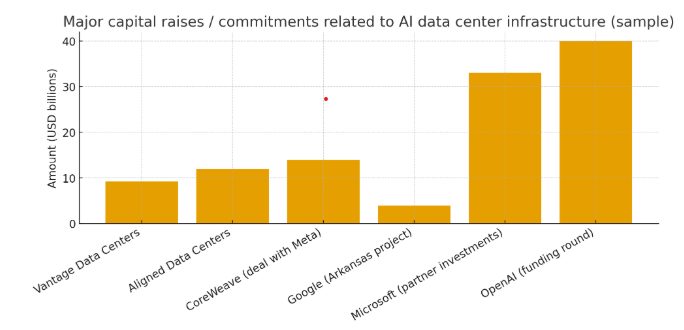

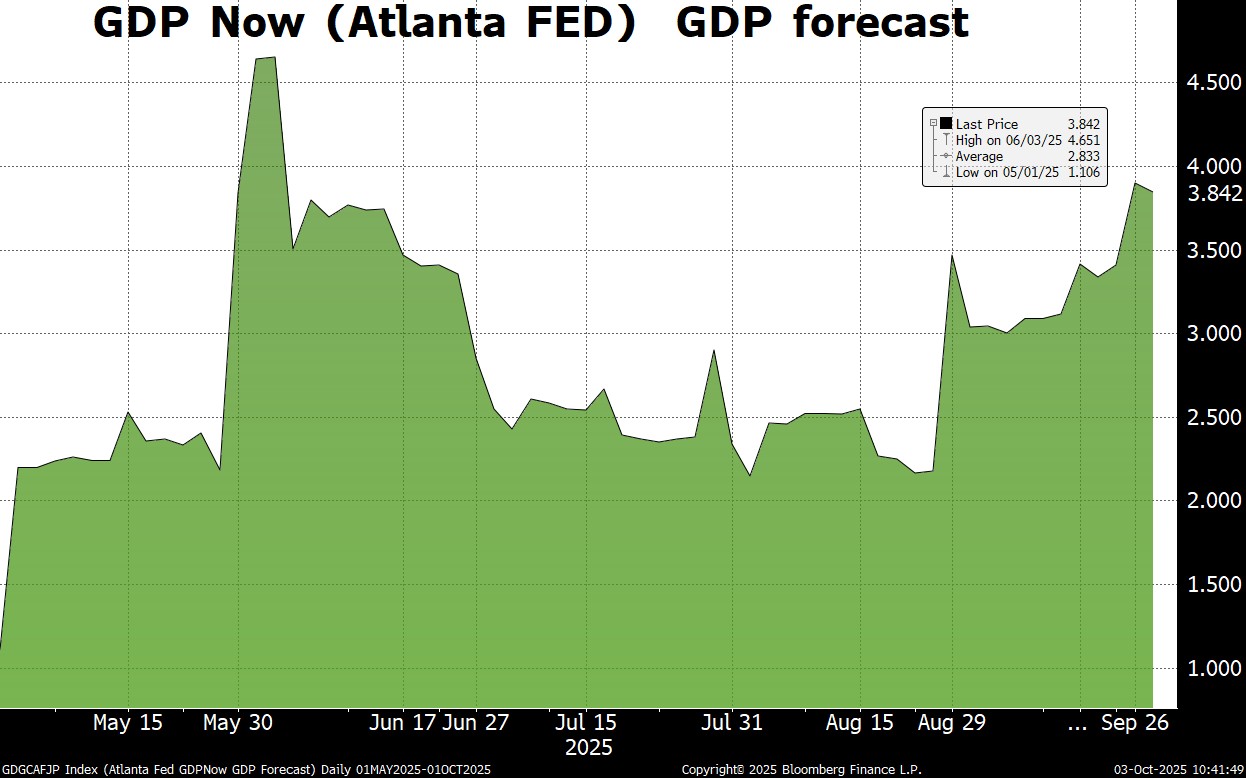

Smart World Investment Drives US Economy and Markets to New Heights – Q3 2025 Review & Outlook Overview The US economy is thriving as wealthy visionary investors’ pour billions of dollars into the foundations of a smart world. Over the last decade technologies for making the world smart have emerged and visionaries like Sam Altman, Elon Musk, Jensen Huang, Mark Zuckerberg, and Alex Karp, have led the way in funding and motivating the world to join hands with them and embrace super intelligence. Something that could change the world dramatically. Over the last few years, we’ve seen major investments from the hyper-scalers, hedge funds, and private equity funds, in the first phase of super intelligence, which is inference-based logic. (Figure 1) The construction of Compute and Data centers has started to accelerate and there is a wave of companies benefiting from this secular super cycle that will last for decades. Outsized demand for chip logic, networking, command center software, and power is all part of this super cycle. America is at the center of this exciting consumption theme. China and other parts of the globe who have been asleep have started to wake up and are slowly getting into the game. China is seeking to monopolize technologies for batteries and the mining of lithium-based commodities. America clearly holds the lead on hardware and software compute. Outside of the AI buildout, we see slow to moderate growth from consumption themes that center on entertainment and leisure, healthcare and obesity, digital devices, social media and digitization of data. There is also a modest theme of weapons & defense building for new types of weapons for wars that are fought with drones instead of tanks and manned fighter jets. Inflationary expectations have not moved to the ultra-low level of the past but are manageable and as a result the FED just recently cut rates for the first time. This environment is Nirvana for stocks! Economic Review Q3 2025 Inflation has subsided but we are still experiencing pricing problems in food, meals out, entertainment, movie prices, and visits to theme parks. Tariffs have showed up in food prices and auto prices but for the most part foreign manufacturers and US retailers have consumed most of the tariffs. Solid employment continues to be the backbone of this economic cycle. Unemployment remains at 4.3% or lower. Job openings have declined from the 10,000 per month pace of 2023 but still remain relatively high at 7,000 or more. (Figure 3) Most employers have their team back at the workplace for industries that require and need everyone together. Government debt continues to be the rot in the economy but for the most part it is in the hands of a borrower who is able to print money to service the debt. Consumer mortgage debt is also not a problem and remains at manageable prudent levels, and even consumer installment debt while high has less than a 3% delinquency problem currently. The only debt problem noticeable is in auto loans to subprime borrowers that have had defaults of 10% or more. This is a minor part of the debt in the American economy and will not domino into other areas. Economic Growth Growth in America continues to surprise everyone. The Atlanta FED or GDP now is forecasting 3.9% growth for the remainder of 2025. (Figure 2) While many economists and pundits believe the economy is in trouble there is just not that much sign of it on the horizon. Earnings expectations for the S&P 500 are at their best level in over three years with 12% growth expected in 2025 and similar growth in 2026. While the cyclical side of our economy is showing only modest growth and many parts of it are in recession, the tech and service side of our economy is producing strong growth with the magnificent seven growing earnings at 20% or more. The US Consumer the US consumer remains resilient supported by wage growth of over 3% for the last decade matching or exceeding inflation. While consumer confidence is low retail sales and personal consumption numbers continue to rise at a linear pace. The biggest problem that we have in the US economy is the weak housing sector. Existing home sales are at anemic levels and new home sales are only half of good levels. Consumers are locked into existing homes with ultra-low mortgages and refuse to sell and give up these attractive 2-4% mortgages. As a result, there is not much turnover in housing and any industry tied to home sales is struggling. The weak housing sector has resulted in a manufacturing sector that is in recession with industrial production numbers at levels not seen in over a decade. This is a problem not only for America but for China who manufacturers most of the goods that are consumed around the globe. Financial Market Review The equity markets in America and around the globe did extremely well in the third quarter. The best returns were in secular growth companies tied to what’s going on with technology and the pursuit of a smart world. Expectations rose for artificial intelligence, compute providers, and most of the companies involved in the buildout. Similarly, there was a rise in expectations for the producers of power as well as battery technologies. Apple Computer introduced their iPhone 17 with smart intelligence included that have boosted sales and expectations. Apple has been slow to incorporate artificial intelligence into their phones but is now playing catch-up and the market is excited to see them get into the game. Tesla saw expectations rise significantly during the quarter as Elon Musk positioned himself with one of the best pay packages ever for a corporate CEO with huge rewards for shareholders if he’s able to achieve the goals he set for himself. Tesla’s exposure to robotics and battery technologies add to their already dominant position in electric vehicles. Investors in the healthcare provider industry finally found some relief as expectations rose from extremely low levels as pessimism finally gave way to optimism for better returns in managed-care. Generally large-cap growth stocks far outperformed large-cap value stocks in the most recent quarter. The Russell 1000 large-cap growth ETF rose 10.4% compared to the Russell 1000 value which gained a mere 5.3%. The magnificent seven advanced 21% versus 8.9% for the S&P 500. MACM’s dynamic growth portfolio beat the S&P 500 in the quarter advancing 9.6%. Small-cap stocks which haven’t participated significantly in the equity rally for several years played catch-up and returned over 12% in the quarter. Most of Europe and emerging Asia lagged the American markets with returns in the 3 to 5% range. Likely because there are few companies in these areas of the globe that are leveraged to artificial intelligence or the theme of making the world smart. Real estate has struggled to move higher from extremely extended levels and both REITs as well as prices of individual properties were stagnant in the recent quarter. Bitcoin advanced 6% while fixed income logged very modest returns of 1 to 2%. Economic Outlook The outlook for the US economy is quite good driven by the fundamentals for artificial intelligence and the themes of making America smart. Consumers are gainfully employed and wages have kept up with inflation. Most economists expect GDP growth of 2 ½% in the year ahead and over 12% earnings growth for the S&P 500. The themes of consumption that will continue in the year ahead involve artificial intelligence, entertainment and leisure, digitization of data, e-commerce, social media, electric vehicle production, robotics, battery production, power plant construction, and solar. We are avoiding or minimizing exposure to areas of the economy that are deeply cyclical like energy, commodities, manufacturing of durable goods, or garments and apparel. Financial Market Outlook Equities are better positioned than any other risk asset. The 9% returns achieved in the last few quarters will likely continue throughout the rest of the year. Value stocks will continue to underperform growth stocks and cyclical areas will continue to underperform secular growth areas. We think expectations will rise for energy enablers, battery producers, healthcare providers and hyper-scalers. We think most of the secular growth companies involved in the consumption themes noted above will see strong earnings growth and while their valuations may not expand their growth will drive higher stock prices of 5 to 10% or more. Fixed income returns will likely be modest as inflation and central-bank accommodation will continue to disappoint investors. The mania involved in bitcoin is likely to continue and the companies that surround this industry will benefit. We remain optimistic. Figure 1 Capital Raise for AI Buildouts Figure 2 GDP Forecast

Figure 2 GDP Forecast

Figure 3 Job Opening in America

Figure 3 Job Opening in America

Economic Expectations Bounce as Tariff Fears Ease – 2025 Q2 Review & Outlook

July 4, 2025

Economic Expectations Bounce as Tariff Fears Ease - 2025 Q2 Review & Outlook July 7, 2025 By Mitchell Anthony Overview Economic expectations had a wild ride thus far in 2025. Inflation expectations were off the chart during the first quarter as extreme proposals for controlling trade were implemented and talked about by the Trump administration. Ultimately after the first month or so of April it became clear that Trump’s proposals were mostly threats and unlikely to lead to the extreme problem for prices that were once considered back in January. The markets swooned in the first quarter as the media scared investors into selling shares despite Trumps rhetoric looking more like threats than reality. The rhetoric changed course significantly in the second quarter and financial markets began a steady recovery in April that finished in June with record highs for almost all growth oriented stock indices. MACM’s dynamic growth portfolio advanced by over 14% in the quarter followed by the S&P 500 gaining almost 11%. Securities that went down the most generally came back the most. There were some exceptions with some areas of healthcare developing problems that were not cured quickly. Volatility was high in the quarter. For example Nvidia fell from 142 to under 90 and then back to the160 area currently. This quarter’s performance proved the point that it is difficult trade markets and that investors generally do better than traders.Read moreTrump takes on the Global Trade Crisis with Tariffs that are Spooking Investors

April 5, 2025

Trump takes on the Global Trade Crisis with Tariffs that are Spooking Investors By Mitchell Anthony April 4, 2025 America continues to thrive despite an industrial sector that has been forced into decline by unfair Global trade policies. America’s success is under siege and we must take action to change! While globalization is great in a world with common goals. That has not materialized and the goals of America are not really aligned and shared by the rest of the Globe. America is and has been all about innovation and capitalism, while the rest of the world embraces socialism and communism at the expense of American wealth. This is now forcing America to reverse course from the globalistic path that we pursued in the 90’s. China is a huge threat to our freedom and our capitalistic success and we can no longer give away our wealth to socialistic countries and allow unfair Trade competition. Past leaders have been too weak to take on this fight. While Trump is a lot of puffed air and does not have good poise or dignity, it seems that he is the right medicine for what America needs today!! Read moreOutlook for Markets after Considering Trump Agenda for Government, Immigration, & Trade

March 10, 2025

Outlook for Markets after Considering Trump Agenda for Government, Immigration, & Trade By Mitchell Anthony March 11, 2025 Recession or Growth under Trump? President Trump is a pro-growth leader and seeks policy that will help America grow and prosper. President Trump's agenda centers on economic growth as well as stability and growth in the financial markets and he would not stand by and let America’s wealth go into ruin by pushing a reckless agenda that push America into a needless recession, as the pessimists forecast. Trump is strong and wants to take on problems that no other leader has had the courage to embrace. However, Trump is unlikely to lose his vision for continued prosperity for Americans as he seeks to bring about substantial change. Trump has embarked on a path to make significant changes to Immigration, Trade, and Government (Americans “BIG 3” problems). These changes are intended to create growth and better opportunities for American business and consumers, as noted below. Certainly, there are some unknowns about the collateral damage that may occur as he pursues these agendas and he will need to keep his foot on the gas and the brake to steer the ship carefully over the next four years. Investors were not ready for such quick decisive action on the Big 3 and have sold stocks even though the environment ahead does not look like a problem for inflation, interest rates, or growth (the drivers of markets)! It would appear that Investors are being provoked into selling by reckless rhetoric from Trump haters who have gained a podium by the liberal Trump hating media. It would seem that if the markets continue on this path that they got on to two weeks ago Trump will quickly move to pause the press for change as his goal on the Big 3 will stand secondary to his goal of helping America build wealth. Currently Nasdaq is off 12% and the SP500 is off 9% from its high achieved 3 weeks ago. MACM’s DG portfolios are also off about 10% from from highs of 2-3 weeks ago. With the SP500 and the MACM DG portfolio at all time highs just 3 weeks ago and now 10% lower one must wonder what has occurred? Obviously things did not change that much in 3 weeks leading us to believe that this is mostly an emotional selloff by investors who dislike Trump and others who don’t understand the need to address the BIG 3 problems facing America. We believe the current selling will end soon as pessimistic investors pause and wait for evidence that the feared problems are becoming reality. Currently the inflation/recession talk is only speculation. Read more