Equities Rock Again – Are New Highs Ahead?

July 3, 2023

By Mitchell Anthony

Investors have returned to risk assets as recent economic data shows a Goldilocks like scenario unfolding yet again. A year ago it was unthinkable that the economy could slow enough to cause inflation to hit a wall without economic growth hitting a wall as well. Somehow the unthinkable is playing out and this Goldilocks like scenario has caused investors to embrace risk assets and give up safe returns of 5% or more in ultra-short treasuries. The S&P 500 rose 8.7% in the second quarter, MACM’s dynamic growth portfolio rose 11.3%, and NASDAQ triple Q’s rose 15.3%. While all of these indexes are still 5 to 10% below all-time highs there has been a substantial bounce in equity markets over the last six months, making an assault on new highs entirely possible. Value stocks were abandoned in favor of sexier growth stocks with the Russell 1000 growth Index advancing 12.8% compared to the Russell 1000 value index returning only 4.1%. The allure of fixed income was lost and treasuries for the most part were down 2 to 4% in the quarter.

The stability of the economy combined with much lower inflation drove the performance in the markets!

Consumers led the way with new optimism for a soft landing

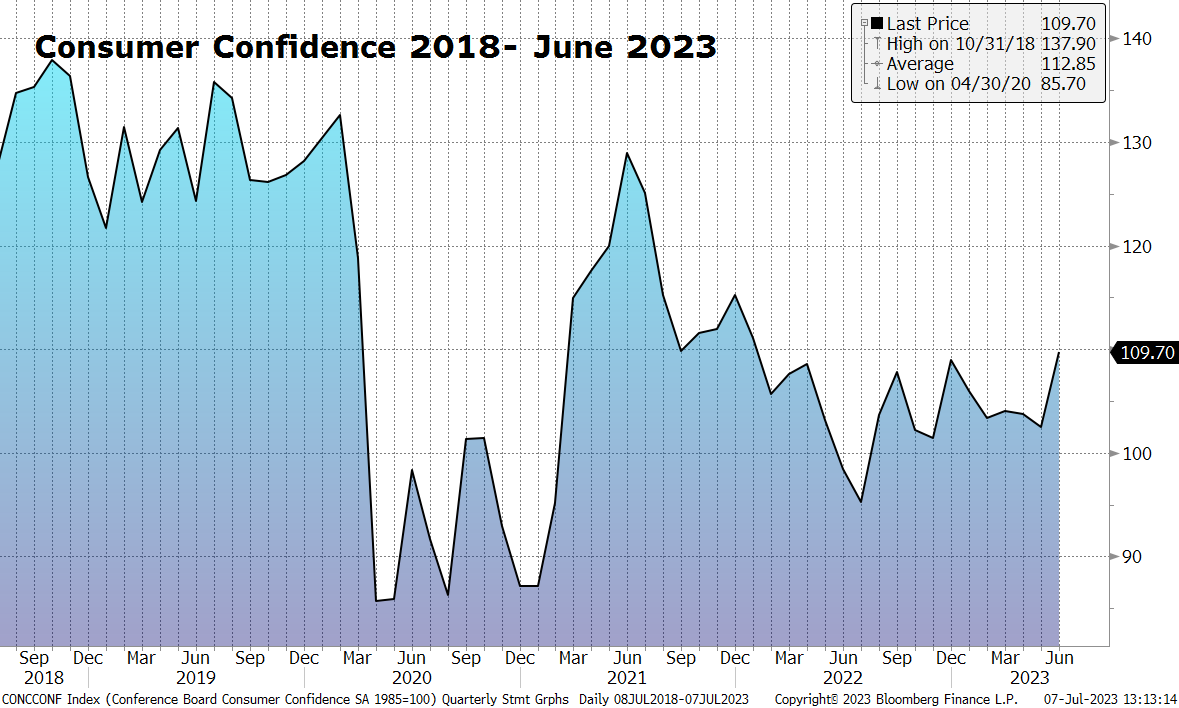

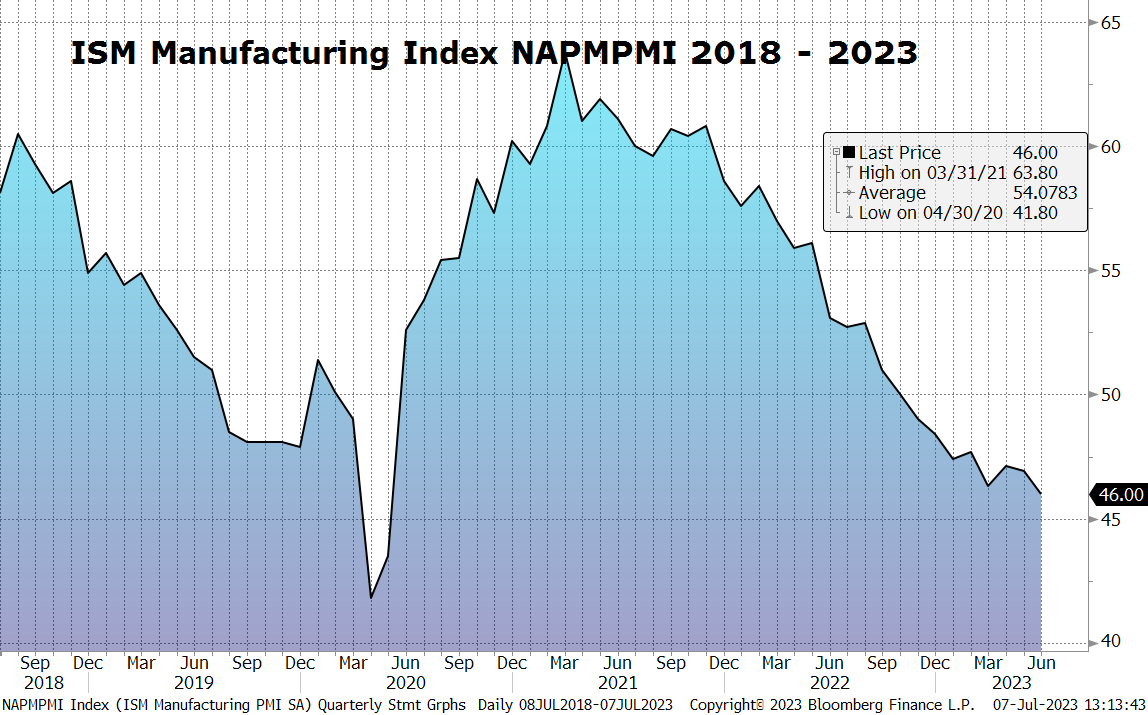

Consumer confidence rebounded by 9% in the second quarter in stark contrast (chart 1 ) with the purchasing managers survey of what corporate America thinks about the economy sinking to new lows. (Chart 2) The NAPM index fell to a new low of 46 during the second quarter. Any reading below 50 is largely related to recession or the onset of one. Corporate CEOs have been expressing pessimism about their businesses since the fourth quarter of last year believing that a big slowdown in the consumer was on the horizon. The FED forecasted a bit of a slowdown as well. Thus far this has not materialized and the CEOs look misguided.

The US Economy is driven by consumption and while the direction of our consumption is up for debate, the most recent economic data shows strength that was unexpected. Further most economic cycles end when rot is discovered somewhere in the economy. Economists have been combing economic data trying to uncover any rot that is substantially enough to cause this cycle to bust. For the most part nothing meaningful has been found with the most concerning discoveries seen in commercial property. Softening economic conditions combined with a work from home theme that has continued has pushed commercial property prices lower with vacancy rates now at levels unseen in decades.

Several Leading indicators still showing strength

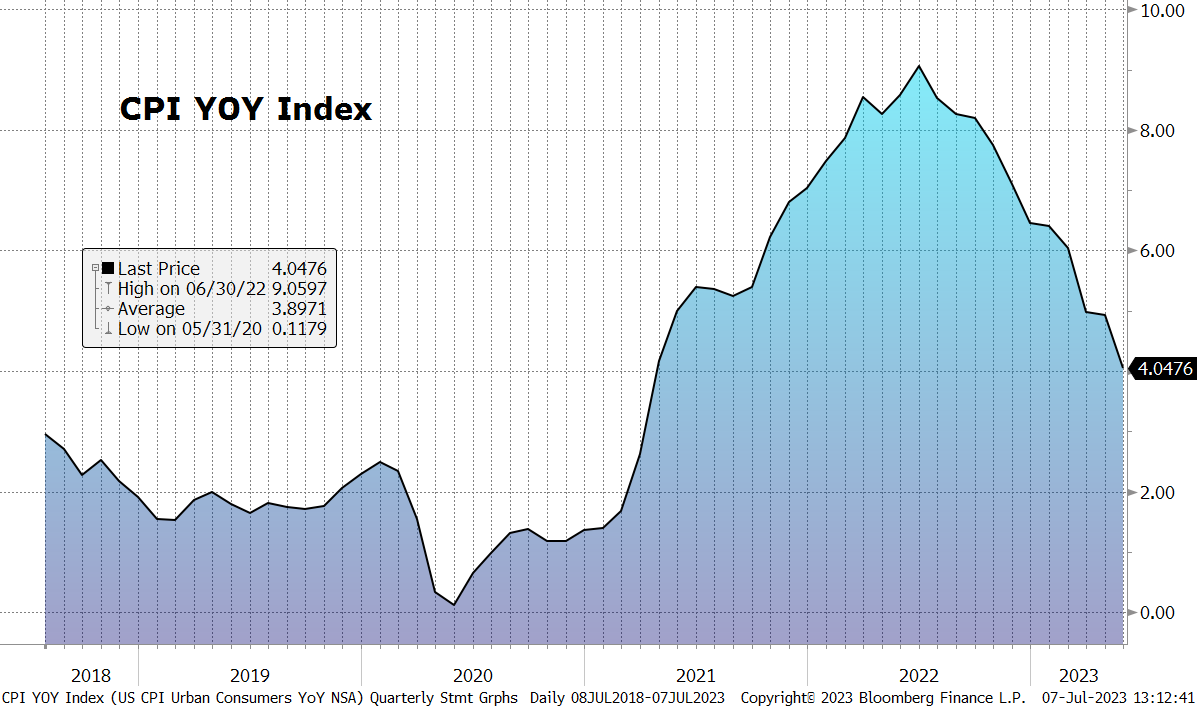

While inflation has slowed from an annual rate of over 6% in the first quarter to an annual rate of 4% in Q2, it is still a bit on the high side and shows strength in the economy. Consumers are still willing to pay higher prices for things and use more expensive debt to finance their purchases. Unemployment is another leading indicator showing strength and while the rate has risen from 3.4% to 3.7% it is still at historical lows. The reasons for this very low unemployment are not clear but there are certainly some stories that can be told. There are both cyclical and secular themes at work keeping unemployment at historical lows. The best explanation has to do with workers that have just left the workforce. The wealth that has been created over the last three decades explains much of this. People are able to retire earlier than they had planned because of growth in wealth. Further millennial’s are less motivated to work or at least work long hard hours when they know they will be receiving substantial inheritances as their baby boomer parents pass. Countering that trend would be the work from home theme that would seem to keep people in the workplace when they might’ve left previously because of unhappiness with a long commute to work or too much accountability at the workplace.

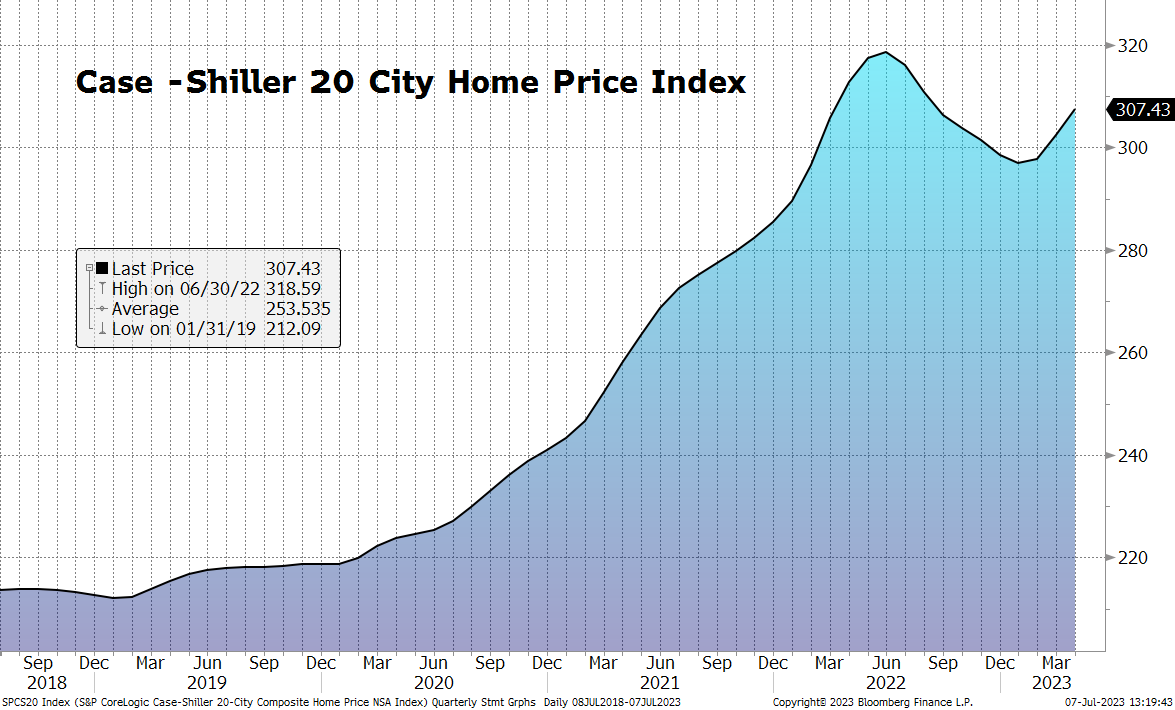

Home prices which were tilting downward over the last year turned back upward in the second quarter with most indices showing 1 to 4% gains. Looking more closely at economic data we do see weakness in retail sales that is rooted in consumers lack of demand for goods and a higher interest rate environment. Nominal retail sales are flat and inflation-adjusted retail sales are 4 to 6% lower over the last year. Personal consumption measures are a bit higher measuring 2% after inflation or 6% nominal. These gains are mostly explained by the fact that personal consumption measures from the Commerce Department includes services whereas retail sales numbers are entirely goods. Consumer services are much stronger and in higher demand that goods. Consumers have a good appetite for travel and leisure activity that has remained strong. Personal income remains high but has showed some signs of flattening over the last month or two. Consumer wealth has bounded back with stocks, real estate, bitcoin, all making significant gains from their lows of last year.

Lots of Leading indicators showing slowdown and weakness ahead.

Obviously at the front of the line of leading indicators flashing weakness is the cost of capital and the access to borrowing. Banks have capital problems because of poor investments they made in long-term treasuries when interest rates were low. Short-term treasuries rose by 90 basis points in Q2 and ten year treasury rates rose over 50 basis points. Mortgage rates saw a smaller rise of approximately one quarter of 1% percent or 25 basis points. Prime in a similar manner rose by 25 basis points. Higher cost of money and problems at banks are effectively strong brakes on the economy. Retail sales as adjusted by inflation were down 4-6% over the last year. Excess savings for consumers is nearly gone and further consumption above income will have to be financed. This can be seen in the sharp increase in the use of credit card debt. Notably though, consumer household debt service payments as a percent of income are nearly at historic lows, anchored by relatively low home payments for the vast majority of consumers with low mortgage rates. So the consumer may still be strong enough to sustain for some time with increased borrowing costs elsewhere, especially given the continued strength in the labor market. The biggest problem for the economy likely lies in the fact that existing home sales remain extremely low. Consumers are reluctant to give up their 2% mortgages to buy a new home with a 6 to 7% rate. Existing home sales drive substantial purchases of durable goods and construction supplies. This is the soft underbelly of the economy right now. New home sales are doing much better but new home sales have a much smaller impact on the economy than existing home sales. Corporate purchasing is down as mentioned earlier with no sign of strength on the horizon. Manufacturing and factory orders are flat and at low levels.

Themes of Consumption that are still in place.

Every good economic cycle as themes of consumption that drive it that act as the engine of economic growth. Housing has always been one of the better themes of construction during good economic cycles. Spending on technology has also been a theme that’s been notable in many cycles over the last few decades. Both of these themes are still alive and well in our current economic cycle. It’s kind of hard to believe that with interest rates more than double where they were a year ago that new home purchases and housing would be a strong theme of consumption in America. Unfortunately as mentioned above existing home sales are not participating in this party causing the theme of housing to be underwhelming. Technology has driven many cycles over the past few decades and is alive today. It is playing out in many different ways from smart homes to artificial intelligence to computer hardware and software for web services. The theme of web service is unclear and there has been weakness broadcast from the three main players of Amazon, Google, and Microsoft. All have stated that the growth in their web service business is running about half the rate it was running at previously. We hope for an update on the status of web services when Amazon Microsoft and Google report later this month but right now the last piece of data we had came in April which was quite bearish. Despite this soft Outlook the stocks have returned to favor in the market as the fear of their problems turned out to be much worse than the reality of their problems. Further artificial intelligence has started to show many many applications in the global economy and demand for the chips hardware and services that make these robotic engines work could not be better. All of this plays into stronger demand for web services so companies can leverage what they are doing with artificial intelligence. The demand for digital devices is also at the heart of this economic cycle. Apples production of iPhones, tablets, and laptops continues to grow and these items are almost like a household staple to consumers today.

Covid kept everyone at home for over two years and as result there continues to be pent-up demand for travel and entertainment and so experiences are strong and hotels, restaurants, and airlines are all experiencing growing demand. The cost of labor unfortunately is keeping that rising top line from making it to the bottom line particularly for restaurants. The stay at home theme of consumption which has driven sales of everything used in the home to all-time highs seems to have lost its grip on the economy as demand for durable goods continues to sink.

Financial Market Review

As noted earlier the financial markets had a terrific quarter and are having a terrific year. While all of last year’s losses have not been made up there has been significant progress made and we will not be surprised if new highs in equity markets are seen before the end of the year. For the last decade equity markets were the beneficiary of TINA (there is no alternative). Investors were forced to embrace risk over the last few decades because interest rates were near zero and returns in long treasuries were far too risky with rates near zero. While some consumers put their money in treasuries and so did our banks this proved to be the wrong investment and most investors including MACM embraced risk assets in the largest manner they have in history. Having no alternative was a strong reason to invest in stocks and other risk assets believing that money would stay in risk assets until there was an alternative. In 2022 an alternative developed which drew money out of risk assets causing them to decline 10 to 20%. Now in 2023 money is returning to risk assets despite the fact that Tina has not returned just yet. While 5% returns are available in six months treasuries 5 to 10 year treasuries only yield 3.5 to 3.7% and apparently this is just not enough with inflation still above those returns to cause investors to be satisfied with fixed income returns that are negative after inflation.

The equity market advanced 8% as measured by the S&P 500 in the second quarter. Growth stocks led the way and value lagged badly. The value sector is largely composed of banks and industrial names that are very cyclical and tied heavily to housing. As mentioned earlier, existing home sales are really not budging and as a result these industrial and banking names have a bleak outlook for growth. The excitement in artificial intelligence and what it will do to productivity for corporate America and how it will make the lives easier for consumers in a similar manner to what the Internet did for us over the last two decades seemed to be behind a renewed move to technology stocks in the second quarter after several quarters of flat performance by FAANG names and the triple Q. Consumer cyclical areas of the equity market likewise did well particularly the areas dominated by mega-cap companies like Amazon and Tesla. After several quarters of our performance by energy this sector took a break in the second quarter as investors got more excited about electric vehicles and artificial intelligence. I bought my first Tesla Model X just recently. While a Tesla is not as luxurious as my previous German autos, I am enjoying the benefits of not having to stop at the gas station for high-priced fuel as well as the performance of an electric that is far better than that of a carbon system.

The fixed income markets were flat to lower in the second quarter. Long treasuries were down 3% and short treasuries were down 2%. Corporate bonds were flat to slightly lower as well as mortgage bonds. High yield bonds likewise underwhelmed investors in the second quarter with returns of 1 to 2%.

While real estate prices in the economy tilted upward a bit we did not see the rebound in REITS that you might expect after this sector of the stock market was hit hard last year as investors tried to get in front of what they thought was a train wreck for residential and commercial real estate. The train wreck has not happened in residential real estate but yet the rebound in the underlying REITs has not yet occurred. Homebuilders seemed to of been the best beneficiary of what’s going on with housing with most advancing to all-time highs in the second quarter.

The outlook for the financial markets is always difficult as it relies on accurate forecasting for the outlook for inflation, Fed policy, and economic growth. It seems that the Fed will get inflation re-anchored at 2% over the next year. It also seems like this will happen without a bust of the economy. The question is will short rates go another 50 BIPS higher before the Fed’s job is done and will those higher rates draw money out of equities and into fixed income. Unless long rates move higher along with what the Fed is doing with short rates I would postulate that further hikes in rates by the Fed will not bring down the equity market.

We remain optimistic

Chart 1

Chart 2

Chart 3

Chart 4