Nervous Investors Return to Risk Assets…But Economy Remains too Strong??

January 19, 2024

By Mitchell Anthony

Investor’s hunger for high returns has driven liquidity back to risk assets despite nervousness about the direction of interest rates. Risk assets have performed like a yoyo over the last year as expectations for inflations have been up and down with changing economic data. There are no clear answers to some obvious questions that are on the mind of investors regarding the need for lower inflation? Will employment soften and will consumption decelerate? Investors are clearly hoping for weaker economic data that will support lower interest rates, friendlier fed policy, and as a result higher asset prices. Given the rise in interest rates that we have experienced it is only natural to think that consumption and employment will soften leading to sustained lower inflation. However this has not occurred yet and consumers continue to spend. While many investors worry there is something terribly wrong with the economy and a bust is on the horizon , the real problem is that the economy has too much underlying strength. Softer growth will be great news for stocks and bonds.

After poor performance for risk assets in the third quarter of 2023 money returned to risk assets in Q4 reversing the downward trend pushing stock prices close to historical highs. Investors bought stocks, bonds, REITS, and Bitcoin in Q4. The S&P 500 advanced 11.6% in Q4 after falling 4% in Q3 treasuries advanced 13% in Q4 after falling the same 13% in Q3. REITS advanced 17% in Q4 after falling 3% in Q3. Quite a yo-yo!

The S&P 500 advanced 26% in 2023 while MCM’s dynamic growth portfolio advanced 32% in 2023. Both portfolios are up at their high watermarks achieved back in December of 2021. Can stocks make new highs in 2024? For stocks to move higher either rates have to come down or corporate earnings have to move up substantially in the year ahead. Investors seem to be betting that maybe a bit of both will occur and have looked away from the potential problem of higher rates if the inflation problem reemerges.

Economic Review Q4 2023

Economically almost everything looks the same today as it did for most of last year. Economic growth continues to surprise on the strong side. The economy seems to have just enough economic capacity and very little excess to cause an overhang or problems with jobs. Consumers are still gainfully employed earning the largest salaries they have ever in history. Retail sales are strong and growing at over 6% annualized in December. Virtually no economic rot has emerged other than the overhang in commercial real estate that is due to consumers working and shopping from home.

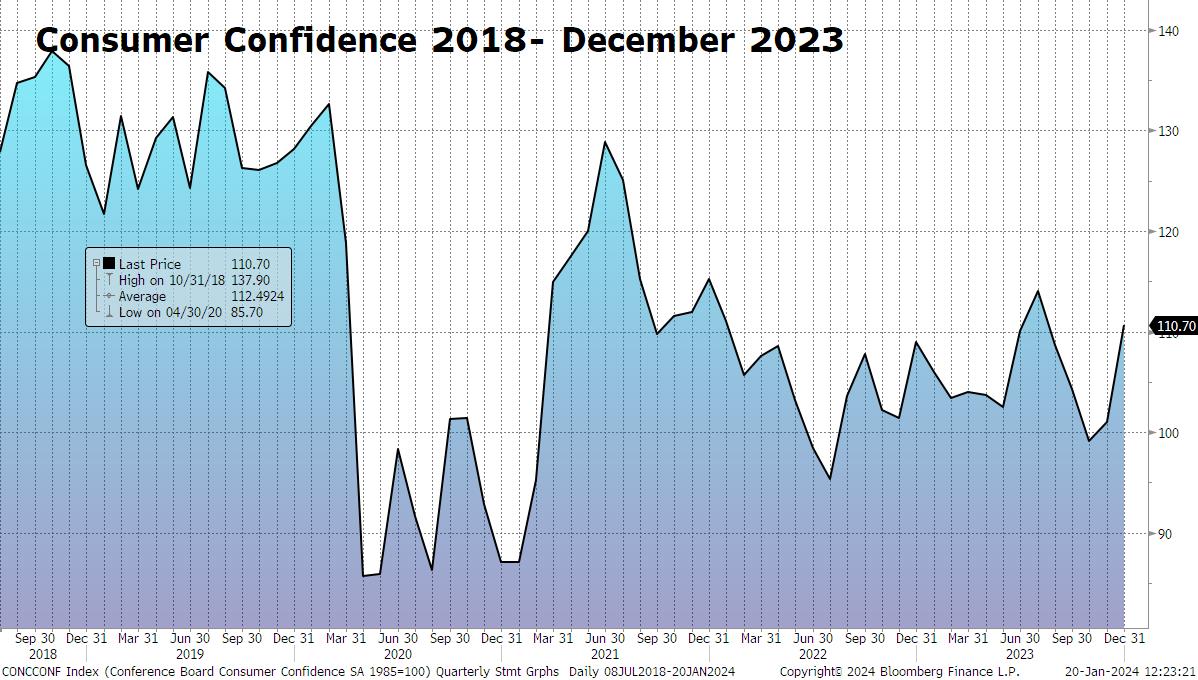

Despite lots of talk of banks having capital problems nothing has really emerged in terms of a liquidity crisis. Unemployment remains low at 3.7% up a bit from 3.6% at the middle of last year. Consumer confidence has been volatile and back and forth from 100 to 110. (Figure 1) Home prices are at all-time highs for the most part despite existing home sales that are near record lows.

There has been lots of concerns about consumers being tapped out of cash and short on credit and unable to spend but this has not shown up yet in any retail sales data or consumption data. In fact the data shows resilience on the part of consumer spending.

Themes of Consumption that are still in place.

- Defense products steady.

- Healthcare services strong.

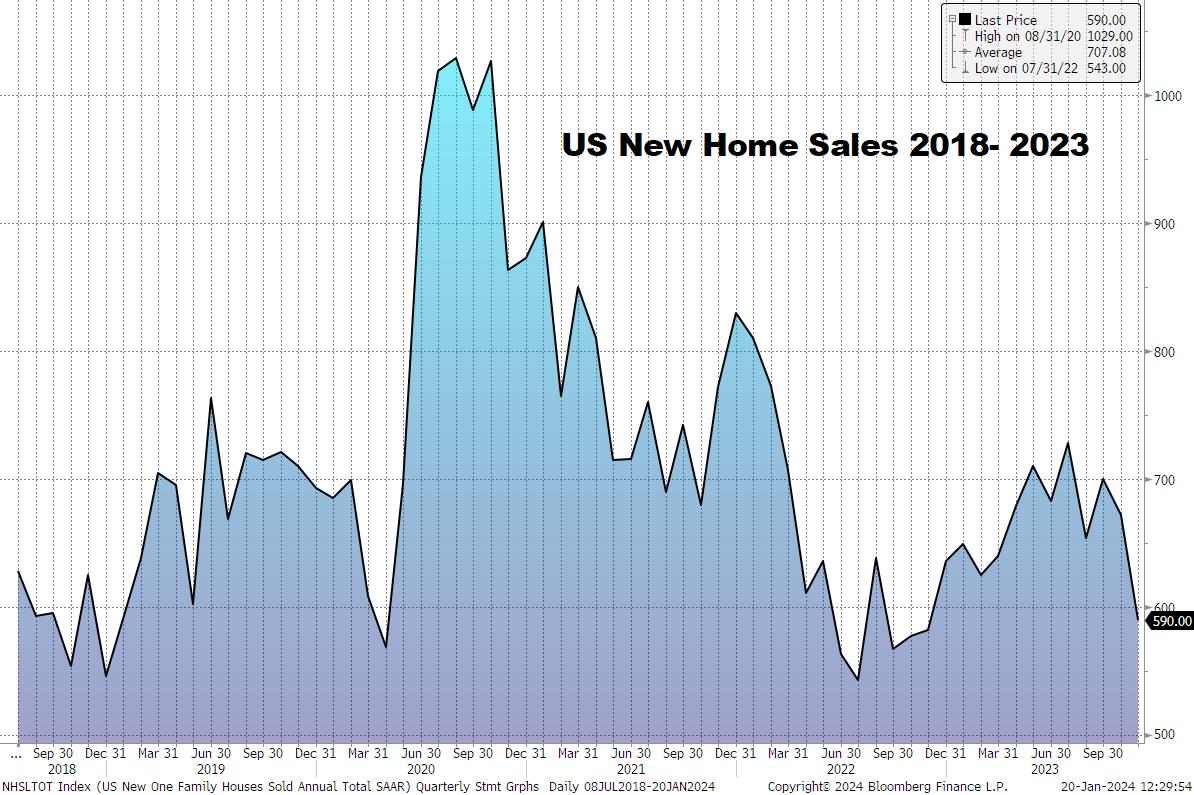

- New home sales holding at modest-moderate levels. (Figure 2)

- Experience demand still strong.

- Travel strong.

- Eating out remains strong and growing.

- Restaurants struggling with labor costs hurting profits.

- Web Services status is unclear? Talk of AI strength reinvigorating growth for web service companies like Amazon Google and Microsoft has emerged!

- Digital device demand strong.

- Apples iPhone sales have decelerated and the growth outlook is not great. However what’s exciting about apple is the fact that this phone is a great vehicle for advertising and digital payment services that apple is now offering. No one else has a comparable platform to provide digital payment and advertising on such a widely used product. Great growth ahead for apple given this position they have with phones.

- Stay at home consumption – Ecommerce

- E commerce from home still strongly intact and penetration is still not mature!

Financial Market Review

- The return on non-risk assets has tilted back lower by over 100 basis points – Is TINA back?

- Fixed Income prices higher as slower growth expectations develop.

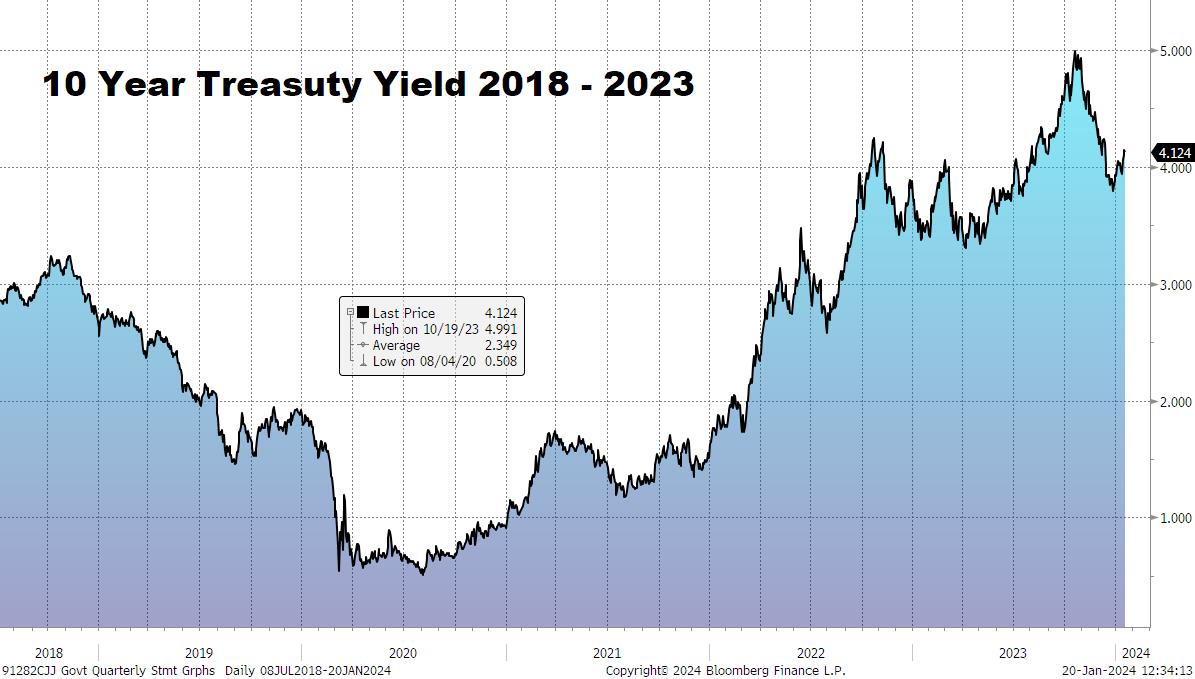

- Inflation has moderated & Treasury yields fell from 5.1 to 4.0% today. (figure 3)

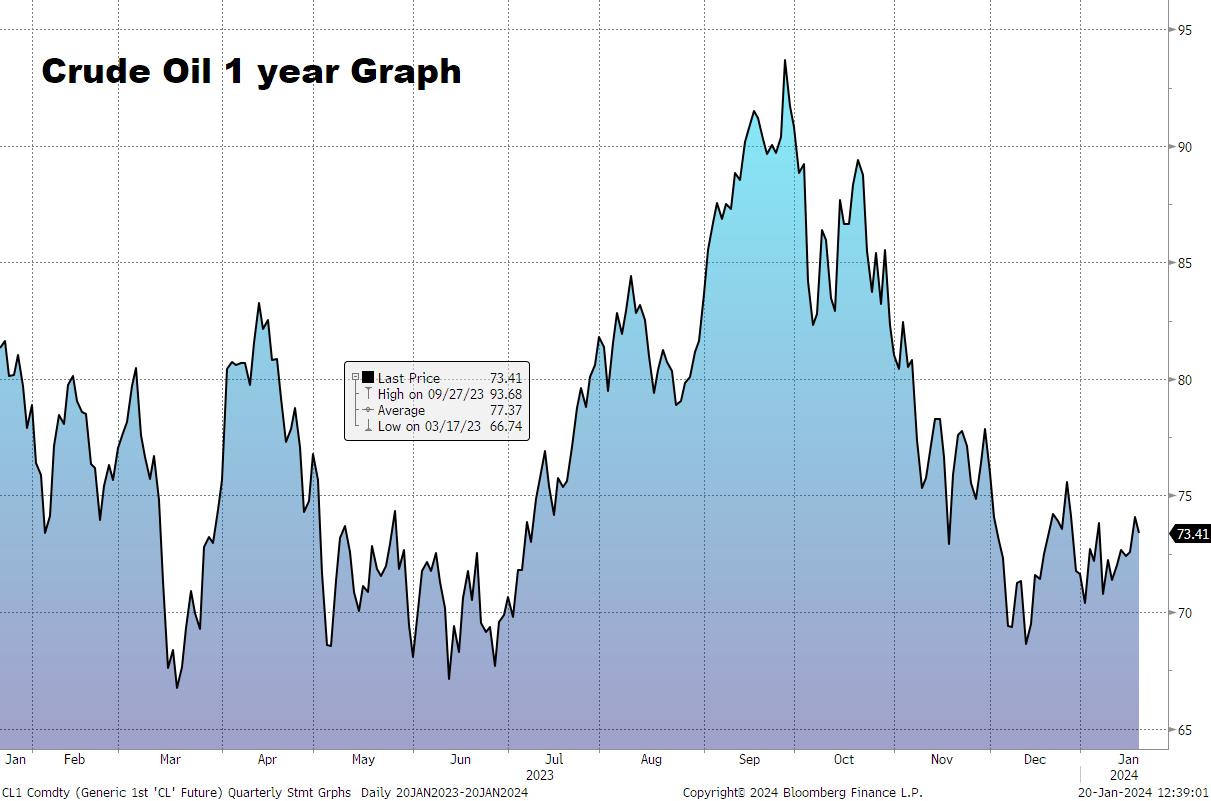

- Oil is down 20% as slower growth expectations hit energy further. (Figure 4)

- Equites up 11.6% (SP500) QQQ up 17% as Lower inflation seems a bit more probable then high or stubborn inflation.

- Mega cap Stocks higher, but mostly a move back into tech and consumer cyclical names. Value names are not exciting in a world of slow growth. What is exciting is the secular growth themes in our economy that is the wind at the back of the Magnificent 7.

Equity Market Outlook

We have been concerned that inflation would be stubborn in its descent from the 9% levels of 2022 back to the 2% levels demanded by the Fed. This has indeed happened as the decline in inflation has seemed to pause here at the three to 3.5% level. Investors seem to believe that the decline is going to happen one way or another and is on the horizon and as a result have returned to risk assets surprisingly but nervously.

Stocks are now back to their December 2021 highs but is everything else the same or are things better or worse for valuations?

As we have said many times stocks are driven by earnings and by the level of interest rates. When rates are low and falling stocks go up, when earnings are advancing stocks go higher as well.

Interest rates have risen over the last year to a level that is substantially higher than where they were for the previous decade for a good reason. This might be a good reason why stocks should be valued lower, however corporate earnings have advanced 10% from 2021 levels and are expected to advance another 10% in the year ahead. Hmmm. Now investors are more focused on the fact that earnings are advancing and have looked away from the prospect of higher rates. Are Interest rates high enough currently to draw capital out of risk assets and into non risk assets? Hmmm. This balance is very delicate and we are close to a inflection point if rates move much higher?

We continue to believe that the Fed will win the battle against inflation but not immediately and that the stubborn inflation of 3% or so will remain for another six months or year and that this will be somewhat of an impediment to higher prices. This will likely produce volatility in stock prices. Ultimately I think the inflation battle will be won by the Fed along with a soft landing hence the reason why we are 80% invested in stocks currently. We plan to move to a fully invested position on volatility that we expect in the month ahead.

We remain optimistic.

Figure 1 Consumer Confidence

Figure 2 – New Home Sales

Figure 3 – 10 Year Treasury Yield

Figure 4 – Crude Oil future