Fed Handcuffed after 30 Years of Freewheeling Use of Printing Press

April 12, 2022

By Mitchell Anthony.

The Most Significant Economic Event of the Quarter was not the War

While most of us thought the most significant economic event thus far in 2022 was the impact of the war in Ukraine on consumer confidence. However inflation really remains the most significant economic problem in the world today and its impact that it has on central bank’s ability to monetize our way out of economic problems. The war has only aggravated this problem with food and energy prices still rising.

The Federal Reserve has had freewheeling use of its printing press for over 30 years enabled by inflationary expectations that were anchored at 2 to 2 ½%. Every single recession encountered since 1990 was easily resolved with the Fed’s ability to pour new credit into the markets and monetize our way out of virtually every economic problem we encountered over the last 30 years. With the dollar being the reserve currency of the world combined with ultra low inflationary expectations the Fed acted without hesitation to print money and run its press as often as needed. Unfortunately America has encountered what appears to be a very difficult inflationary environment that may take several years to resolve with tight monetary policy. This is contrary to the belief that was embraced by central bankers around the world in 2021 as the economy emerged from the pandemic lows. Capacity was largely the driver of inflation in the beginning as producers shut down during the pandemic and were very slow to return their factories and facilities to full-scale. At the same time demand ramped up considerably for durable goods and housing as consumer spent a tremendous amount of time at home instead of traveling.

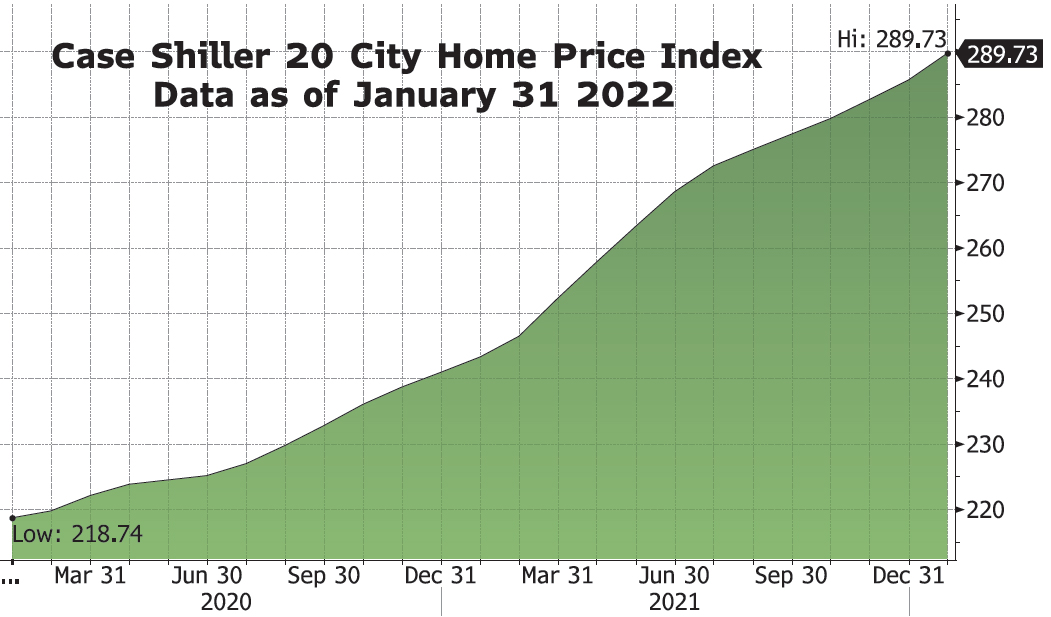

We have never in history had an inflationary cycle end without a recession and a bust in asset prices. Most have thought this cycle would be the exception and many are still optimistic that this will occur but markets are now heavily discounting a recession and a bust in asset prices. The first market to bust was the treasury market where yields have skyrocketed upward to almost 3% over the last 30 days (Figure 2). Investors do not believe the Fed will be able to come to the rescue with cheap money when this economy falls into recession or stays in a period of slow growth for an extended period of time. This is because of the entrenched inflation that may not resolve itself even with a big slowdown in growth.

As investors embrace this reality stocks and bonds have been sold and the first quarter’s performance for both was the worst in several years. The S&P 500 fell almost 5%, NASDAQ (QQQ) over 8% and treasuries (TLT) declined over 10%. MACM’s dynamic growth portfolio fell by over 8% as modest bets on China and reopening names spoiled good relative performance in secular names like Amazon and United healthcare. The big winner in the quarter was energy as oil prices soared to over $120 a barrel briefly during the invasion of Ukraine. Energy stocks (XLE) rose by over 30% in the quarter as oil prices have mostly stayed over $100 per barrel. This has been due to tight capacity combined with steady increases in demand. OPEC conceivably has had more discipline for maintaining production quotas for the last few years than any other period in history. Raw materials in general accelerated in price during the second half of 2021 and the first quarter of 2022. It is reasonable to conclude that energy prices will remain elevated for several years and even into an economic slowdown or recession.

While consumer confidence has fallen significantly because of the war, retail sales have stayed hot and continue to climb to all-time highs. Historically there’s never been a strong correlation between consumer spending and consumer confidence until confidence gets really bad. Growth in the US economy is expected to show a tremendous slowdown when GDP for Q1 is reported for the first quarter next month. Most analysts are projecting GDP growth of 1 to 1.5% for the quarter, down from over 6% growth the previous few quarters. Given the strength in Housing and retail sales it is hard to understand the forcasted slowdown in GDP?

Home Prices and Housing Sales Still Heading Higher?

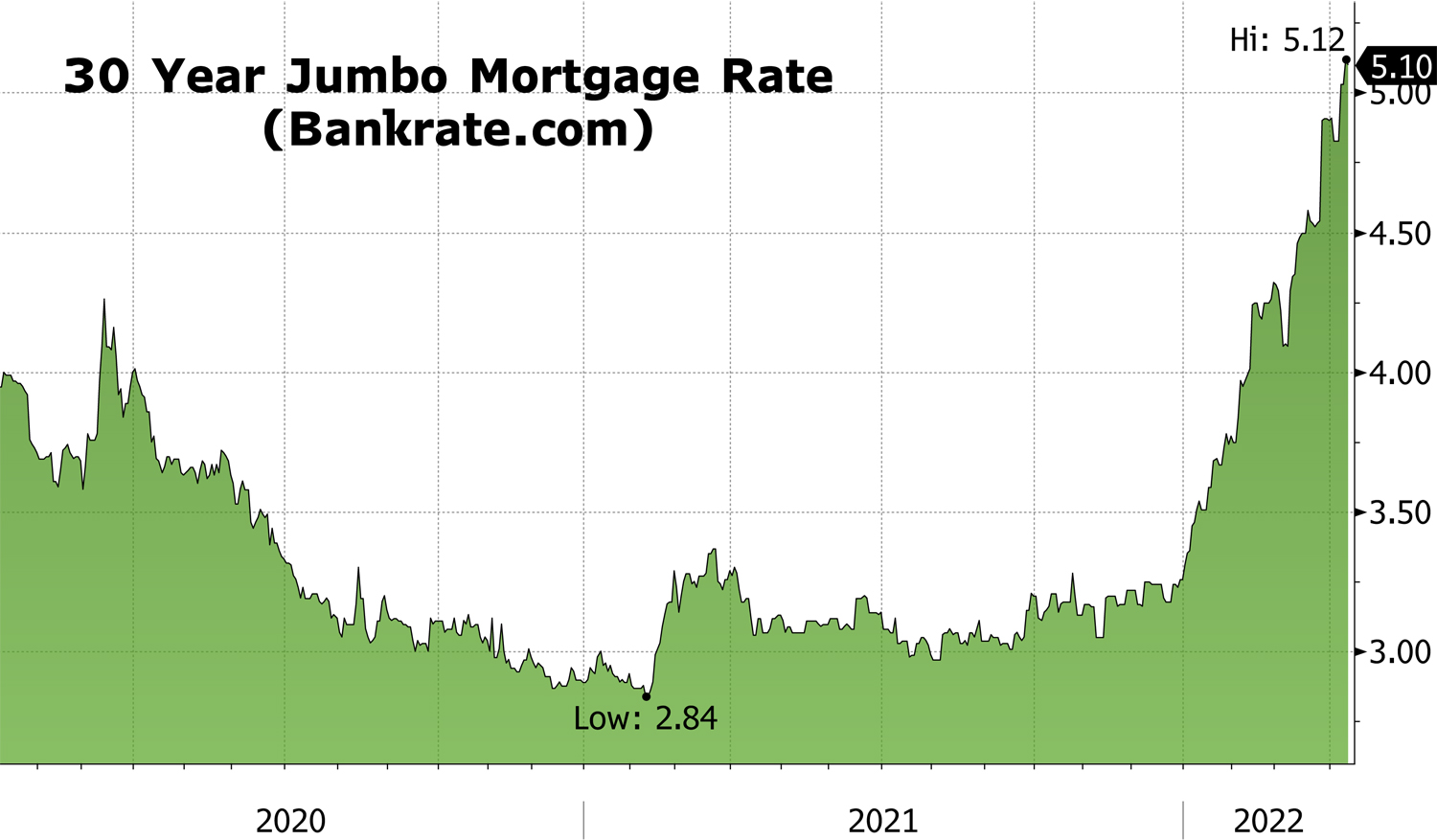

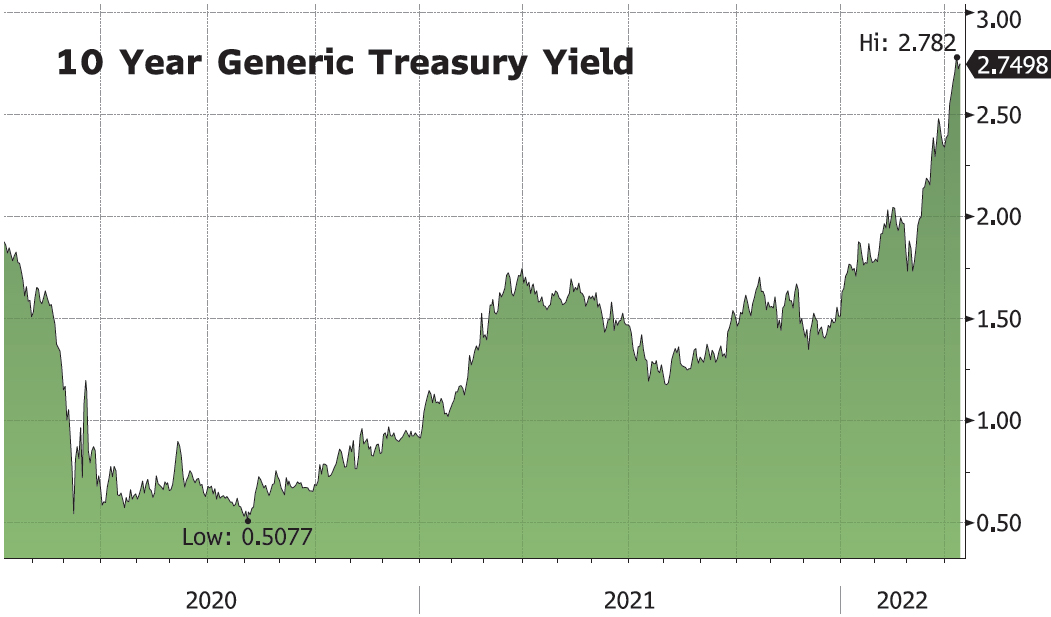

The housing cycle would appear to be still on course however most home price indices are delayed by over two months and so recent data on trends in home prices are a bit unknown. The Case Shiller 20 city home price index rose to an all-time high in January (Figure 1). New home sales have been strong based upon February data with limited supply being added. The Current level of sales is however unknown and we are suspect that a decline is on the horizon or already here – given that rates are now up to 5% or more for most mortgages.

Treasury Rates Heading Higher!

Rates on treasuries have risen significantly over the last few weeks as investors embraced the idea of a handcuffed Fed for an extended period of time. The 10 year rose from 1 ½% to 2.7%, the two-year rose from 2.4% to 2.6% , and mortgage rates as measured by Bank rate rose from 3.26% to approximately 5% (figure 3). Consumers are just now starting to embrace these higher rates that affect affordability of cars, housing, and credit card purchases. Fed posture changed to fear of inflation and being behind the curve from previous posture of inflation being transitory and driven mostly by capacity problems that would quickly resolve. Markets are currently pricing in a fed funds rate of 2.5% by year end. Up from just 0.5% currently.

Consumption Themes Wavering?

It would seem reasonable that we are just in front of a decline in consumption as stimulus effects fade and over-consumption of durable goods plays out. This is countered by pent up demand for travel and experiences. Consumption of Autos, Housing , and Appliances seem set to fall.

Market Outlook

We continue to hope for a soft landing for the US economy. However the probability continues to decline as inflation forces play out stubbornly. The Bond and Treasury Markets will likely continue lower until an inflection point for inflation becomes visible. This is not likely for another 6-12 months. Commodity prices will remain elevated and stocks will likely move sideways. The dismal outlook for fixed income will keep investors in Equities that are defensive and/or benefiting from secular consumption themes still intact. When a peak in rates is visible a move to Treasuries is likely for our portfolios. Defensive stocks and secular Growth names will be emphasized as we adjust allocation to this slow growth high inflationary environment.

Figure 1

Figure 2

Figure 2

Figure 3