US Economy Accelerates – Growth is Notable and Difficult to Explain

Overview

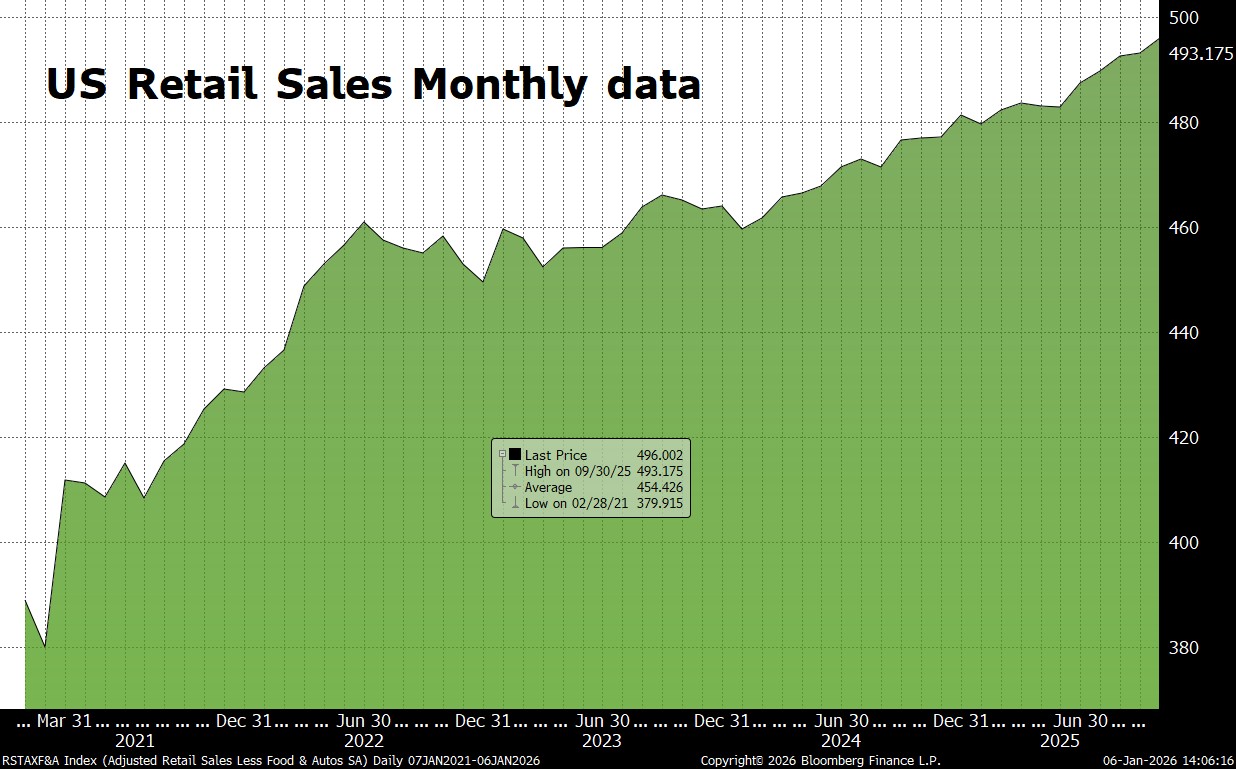

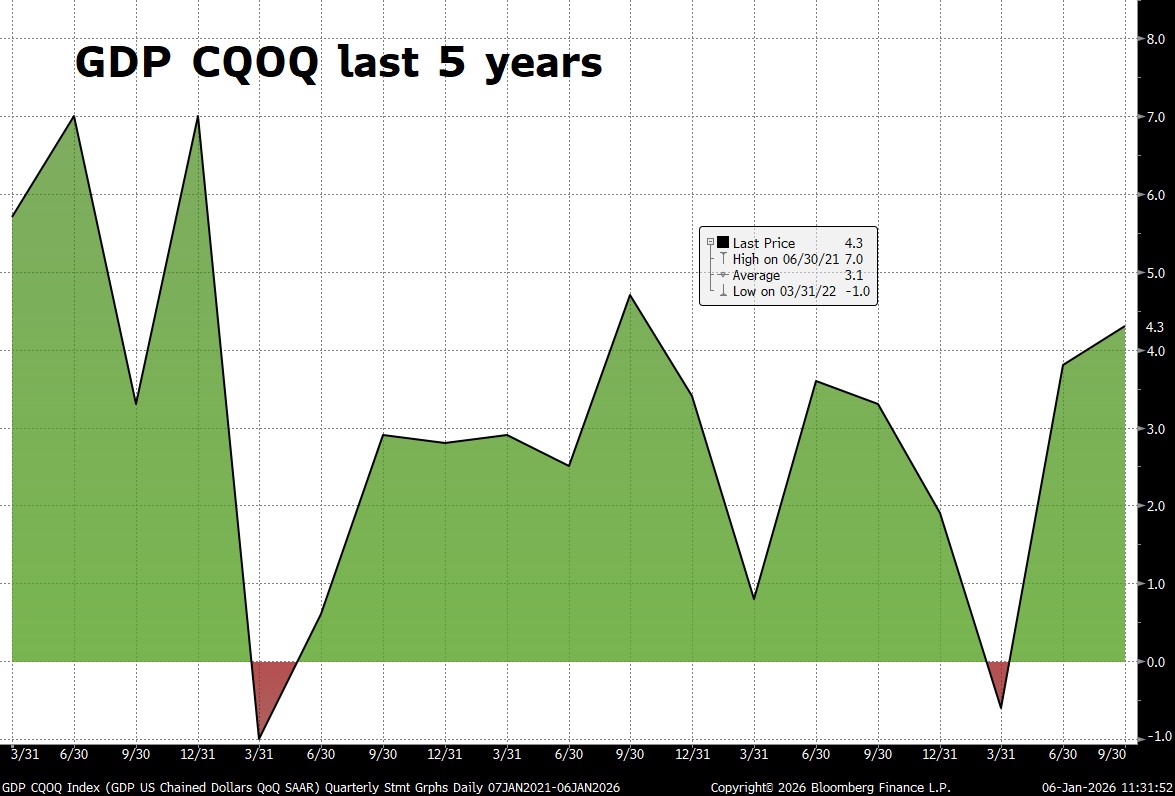

2025 was another great year for the economy and the financial markets. This comes after double-digit Equity returns in both 2023 and 2024 for the S&P 500 and MACM equity strategies. The fourth quarter of 2025 had modest equity returns but economic activity actually accelerated. GDP was over 4% (figure 1). For the year economic activity was robust despite gloomy forecasts from most economists who felt the economy could not stay on the path of strong growth for many reasons. However, earnings growth was strong for the year with the S&P registering over 13% growth in earnings and S&P 500 stock returns were close to 18%. MACM’s dynamic growth portfolio returned over 20%.

The acceleration in the economy’s rate of growth as measured by GDP to 4.3% (figure 1) has been difficult to explain and understand. Clearly employment has been softening and confidence amongst consumers has reached new lows while at the same time the housing industry is stagnant. This is generally not aligned with strong economic growth. For whatever reason consumers have continued to spend and consume. (Figure 3). Entertainment and leisure spending led the way with international travel heading the list. Consumers are utilizing healthcare more than ever and healthcare as seen substantial growth because of this higher utilization rate. Consumers are embracing GLP’s and seeking to lose dramatic amounts of weight driving stronger consumption of these great products. Consumer spent strong on recreational goods in 2025. For the most part the best part of spending was in services and not in durable goods.

Artificial intelligence cannot explain the strong growth we are experiencing.

There is no doubt that we are going through a significant change in the world as the globe seeks to become smart and embraces substantial investments in artificial intelligence to enable super intelligence. This theme of spending on artificial intelligence has been exciting but a closer look at how much money is being spent and whether or not it is what’s driving the economy needed to be done to better explain the strength that we are seeing in the economy. There has been a big upturn in spending over the last few years on artificial intelligence. Lots of market pundits have explained the unusually strong economic growth by noting that over $400 billion was spent last year alone on the artificial intelligence buildout. How significant is this? Well certainly it is not a small amount of money, however, it is relatively small when you consider that the US economy alone produces over $20 trillion of goods and services each year. 400 billion is a very small part of how much is spent in our economy each year and is not nearly large enough be considered a major theme of consumption. The consumer is the main driver of the economy and spends over $15 trillion each year on goods and services. The corporate world spends less than $2 trillion each year and is a smaller player in the US economy. This analysis clearly leads us to conclude that the consumer is the backbone of this strong growth that we are seeing despite all the problems that have got in the way of the consumer like high levels of prices on services and high level of prices on homes and durable goods. Despite these high prices the consumer continues to spend and has been supported by wage growth that has kept up with inflation over the last five years.

A Closer Look At The Economy

Inflation.

We have seen mild inflation in food and high inflation in meals out. Movie prices and park prices are up and entertainment in general cost much more. The rise in prices is over but the level of prices is still high. The inflation that we have seen over the last year did not live up to the expectations of the pessimists who were sure that tariffs would produce double-digit inflation. In the end CPI was under 3% for all of 2025 and the PCE was only 2 ½%.

Employment.

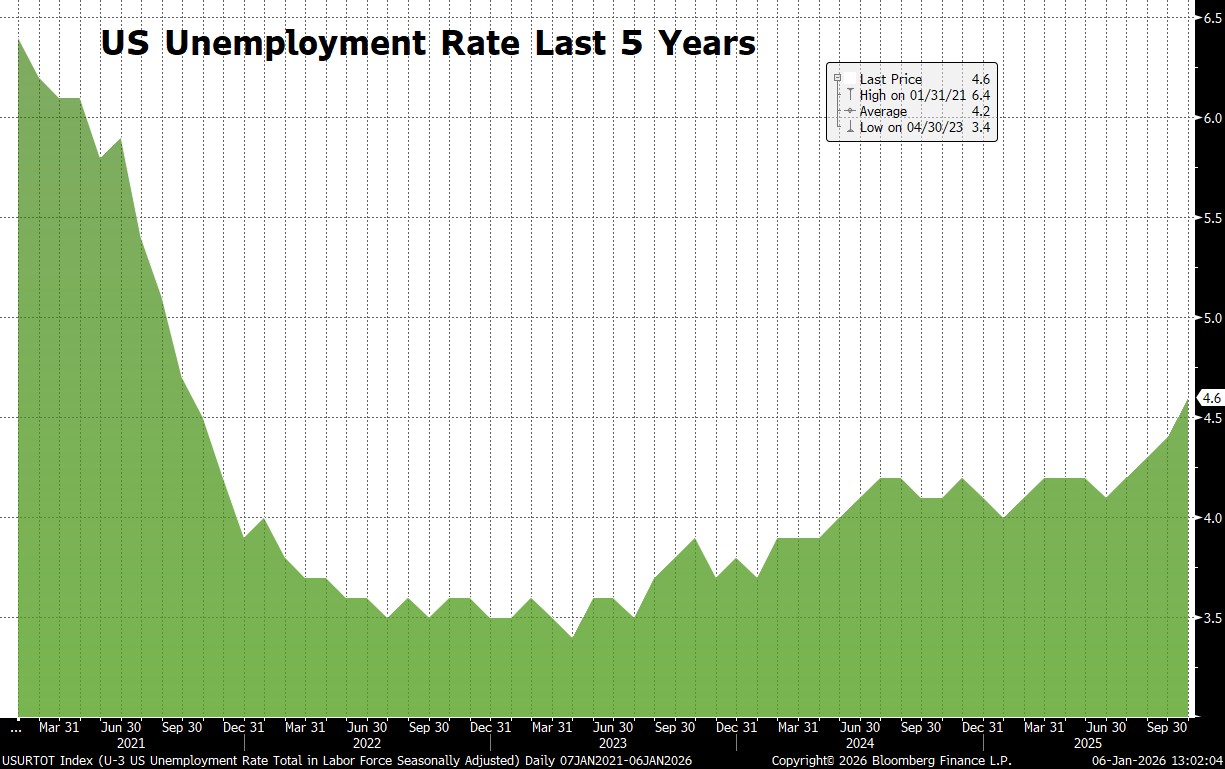

Unemployment has been rising and is now over 4.6% after bottoming at 3.4% in 2023 (figure 2). Job openings are down to 7700 from the over 10,000 level in 2023 but the decline has stopped and has been steady for 12 months. Employers claim to be hoarding labor and capacity as they anticipate the economy staying stronger than the pundits forecast. If they are wrong then unemployment could jump as they let go of the labor they are hoarding.

Financial Market Review

2025 was a great year for financial markets. Equities advanced 15 to 20%, led again by the magnificent seven but small-cap stocks and the broader market also did well posting returns of 10 to 12%. European markets did well in the first quarter but then gave much of that back during the remaining part of the year but still posted double-digit returns. The big burst to the upside in the first quarter that was all about investors voting against America and Donald Trump and his pursuit of tariffs.

Real estate had a disappointing year with single-family homes flat to 1 to 2% higher and most REITs posting modest returns of 3 to 5%.

Precious metals had an amazing year with silver and gold making significant advancements of over 50%. Strangely though bitcoin lost over 6% in 2025! Gold silver and bitcoin have mostly been bought by investors who are fearful of the significant budget deficits that seem out of control and keep growing. Investors fear that they’ll be a bust of some sort and that the dollar and most currencies will lose their value and hence the only way to barter for things in the future will be through the exchange of gold or silver or bitcoin. While this type of thinking seems extreme it seems like the only explanation for the big run up in these precious metals.

Fixed income markets had modest returns in 2025. The Fed did not lower interest rates significantly as many people predicted and that disappointed bond investors and the total return in most treasury funds was about 4% for the year. Corporate bond funds did a bit better returning 6 to 8%.

Economic Outlook

Growth

Economic growth is forecast to be 2.9% in 2026 by the Atlanta Fed. The average market economist has a similar number. Earnings growth for the S&P 500 is projected to be 15% in 2020, a slight uptick from the 13% we saw in 2025.

Earnings growth for 2026 by sector looks like this:

- Tech 35%, Materials 22%, Industrials 12%, Comm Services 11%, Utilities 11%, Financials 8%, Financials, Energy 8%, Cons Disc 8%, Healthcare 7%, Staples 7% and Real estate 5%

As you can see technology is at the top of the list as it continues to benefit from artificial intelligence spending and web computing buildouts. Surprisingly basic materials is at the top of the list as well. Street analysts expect a better environment for most commodities including oil and gas and chemicals. The leader of Venezuela is now gone and the world’s largest oil and gas reserves may well open up to American energy companies. For the most part Venezuela has been closed to opportunities that lie within their natural resources and American companies have been blocked from helping Venezuela develop their energy reserves.

Most of the consumption themes that had been present in the US economy for the last five years will continue in 2026 and some will get better. This includes entertainment and leisure spending by the consumer, e-commerce spending by the consumer, consumption of robots solar and electric vehicles, build outs of artificial intelligence and web compute capacity. Housing and durable goods remain in recession and it is unclear if they will be able to break out of that pattern in 2026 as the same problems exist that have kept them bottled up for the last three years.

Financial Market Outlook

Equities better positioned than other risks Assets! Equities will tilt higher as earnings growth of 15% pushes prices up at least that much. If the street is right with their forecast for earnings by sector than the leadership will follow the earnings forecasts noted above. We suspect there will be some changes in expectations with some sectors doing much better and some sectors disappointing. Our job is to identify that and invest around those discoveries. We expect another modest year for fixed income. Gold and silver are in a mania run and is unclear when it will end. Likely will end when there is visibility that the government is going to start to focus on narrowing the deficit.

Healthcare has surprised investors and has done much better than most pundits forecast. Higher utilization of healthcare services is what is behind stronger earnings from this sector. It would seem that this higher utilization will continue into 2026 and the use of GLP’s will only continue.

Earnings growth for the magnificent seven is forecasted to be 27% quite a bit better than the 15% expected for the S&P 500 and as a result the Mag 7 stocks will likely outperform again.

We remain optimistic!

Figure 1

Figure 2

Figure 3